Question: The cost of debt that is relevant when companies are evaluating new investments is the marginal cost of new debt to be rased to finance

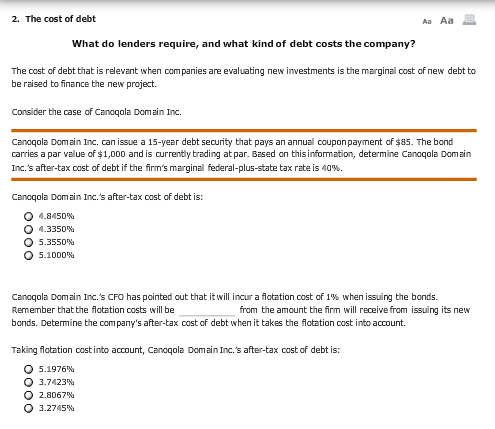

The cost of debt that is relevant when companies are evaluating new investments is the marginal cost of new debt to be rased to finance the new project. Consider the case of Canoqola Domain Inc. Canoqola Domain Inc. can issue a 15-year debt security that pays an annual coupon payment of $85. The bond carries a par value of $1,000 and is currently trading at par. Based on this information, determine Canoqola Domain Inc.'s after-tax cost of debt if the firm's marginal federal-plus-state tax rate is '10%. Canoqola Domain Inc.'s after-tax cost of debt is: Canoqola Domain Inc.'s CFO has pointed out that it will incur a flotation cost of 1% when issuing the bonds. Remember that the flotation costs will be from the amount the firm will receive from issuing its new bonds. Determine the company's after-tax cost of debt when it takes the flotation cost into account. Taking flotation cost into account, Canoqola Dorn an Inc.'s after-tax cost of debt is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts