Question: The covariance matrix C and return vector for three stocks are as follows: [0.02 0) 0.01 C= 0 0.03 -0.02 and ( = 0.06, 0.1,

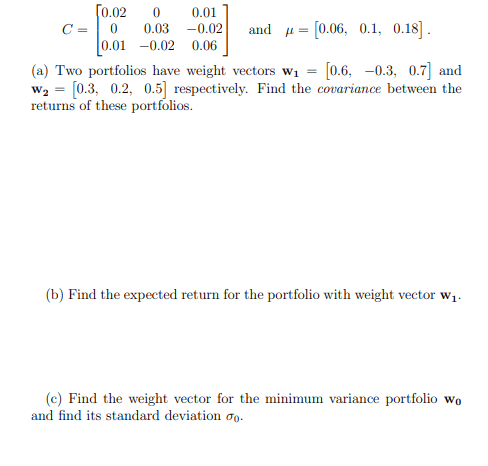

The covariance matrix C and return vector for three stocks are as follows:

[0.02 0) 0.01 C= 0 0.03 -0.02 and ( = 0.06, 0.1, 0.18] . 0.01 -0.02 0.06 (a) Two portfolios have weight vectors w1 = 0.6, -0.3, 0.7] and w2 = 0.3, 0.2, 0.5 respectively. Find the covariance between the returns of these portfolios. (b) Find the expected return for the portfolio with weight vector w1. (c) Find the weight vector for the minimum variance portfolio wo and find its standard deviation co

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts