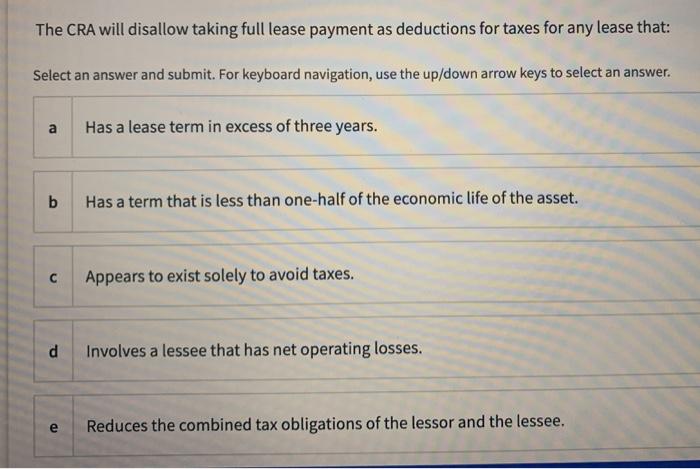

Question: The CRA will disallow taking full lease payment as deductions for taxes for any lease that: Select an answer and submit. For keyboard navigation, use

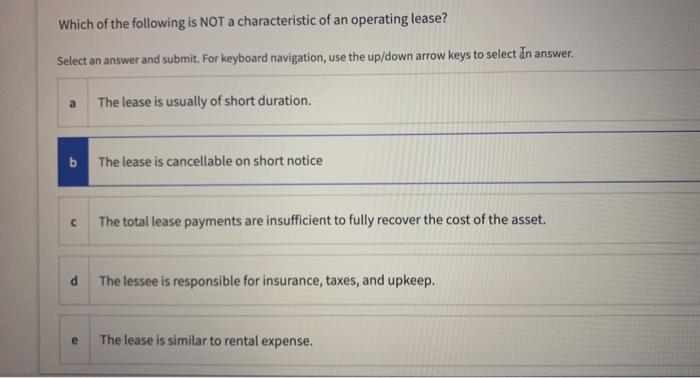

The CRA will disallow taking full lease payment as deductions for taxes for any lease that: Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Has a lease term in excess of three years. b Has a term that is less than one-half of the economic life of the asset. Appears to exist solely to avoid taxes. d Involves a lessee that has net operating losses. e Reduces the combined tax obligations of the lessor and the lessee. Which of the following is NOT a characteristic of an operating lease? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select In answer. a The lease is usually of short duration b The lease is cancellable on short notice The total lease payments are insufficient to fully recover the cost of the asset. d The lessee is responsible for insurance, taxes, and upkeep. e The lease is similar to rental expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts