Question: The Creamer Company has a 90-day operating cycle, inventory conversion period of 60 days, and a payable payment period of 45 days. The companys variable

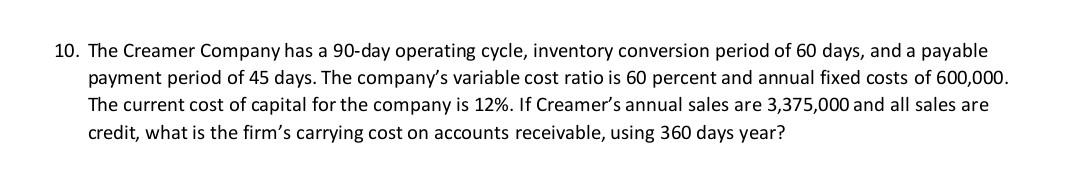

The Creamer Company has a 90-day operating cycle, inventory conversion period of 60 days, and a payable payment period of 45 days. The companys variable cost ratio is 60 percent and annual fixed costs of 600,000. The current cost of capital for the company is 12%. If Creamers annual sales are 3,375,000 and all sales are credit, what is the firms carrying cost on accounts receivable, using 360 days year?

10. The Creamer Company has a 90-day operating cycle, inventory conversion period of 60 days, and a payable payment period of 45 days. The company's variable cost ratio is 60 percent and annual fixed costs of 600,000. The current cost of capital for the company is 12%. If Creamer's annual sales are 3,375,000 and all sales are credit, what is the firm's carrying cost on accounts receivable, using 360 days year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts