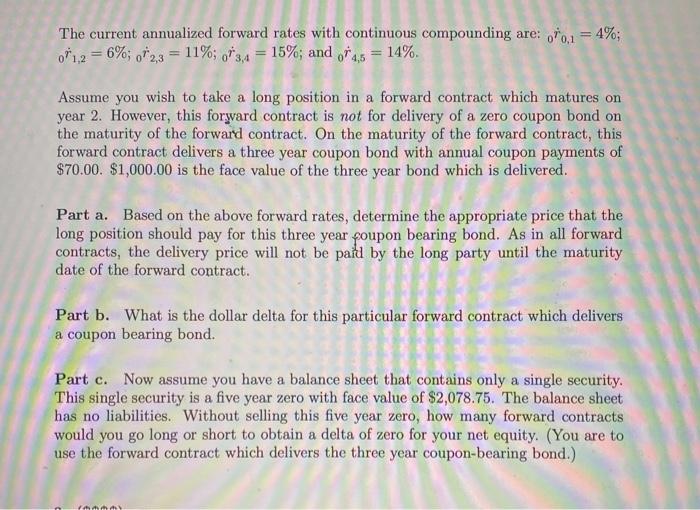

Question: The current annualized forward rates with continuous compounding are: 70.1 = 4%; 001.2 = 6%; of 2,3 = 11%; 3,4 = 15%; and 4,6 =

The current annualized forward rates with continuous compounding are: 70.1 = 4%; 001.2 = 6%; of 2,3 = 11%; 3,4 = 15%; and 4,6 = 14%. Assume you wish to take a long position in a forward contract which matures on year 2. However, this forward contract is not for delivery of a zero coupon bond on the maturity of the forward contract. On the maturity of the forward contract, this forward contract delivers a three year coupon bond with annual coupon payments of $70.00. $1,000.00 is the face value of the three year bond which is delivered. Part a. Based on the above forward rates, determine the appropriate price that the long position should pay for this three year coupon bearing bond. As in all forward contracts, the delivery price will not be paid by the long party until the maturity date of the forward contract. Part b. What is the dollar delta for this particular forward contract which delivers a coupon bearing bond. Part c. Now assume you have a balance sheet that contains only a single security. This single security is a five year zero with face value of $2,078.75. The balance sheet has no liabilities. Without selling this five year zero, how many forward contracts would you go long or short to obtain a delta of zero for your net equity. (You are to use the forward contract which delivers the three year coupon-bearing bond.) fy The current annualized forward rates with continuous compounding are: 70.1 = 4%; 001.2 = 6%; of 2,3 = 11%; 3,4 = 15%; and 4,6 = 14%. Assume you wish to take a long position in a forward contract which matures on year 2. However, this forward contract is not for delivery of a zero coupon bond on the maturity of the forward contract. On the maturity of the forward contract, this forward contract delivers a three year coupon bond with annual coupon payments of $70.00. $1,000.00 is the face value of the three year bond which is delivered. Part a. Based on the above forward rates, determine the appropriate price that the long position should pay for this three year coupon bearing bond. As in all forward contracts, the delivery price will not be paid by the long party until the maturity date of the forward contract. Part b. What is the dollar delta for this particular forward contract which delivers a coupon bearing bond. Part c. Now assume you have a balance sheet that contains only a single security. This single security is a five year zero with face value of $2,078.75. The balance sheet has no liabilities. Without selling this five year zero, how many forward contracts would you go long or short to obtain a delta of zero for your net equity. (You are to use the forward contract which delivers the three year coupon-bearing bond.) fy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts