Question: The current portion of long-term notes payable is _____ a. the amount of principal that will be paid within five years b. included with the

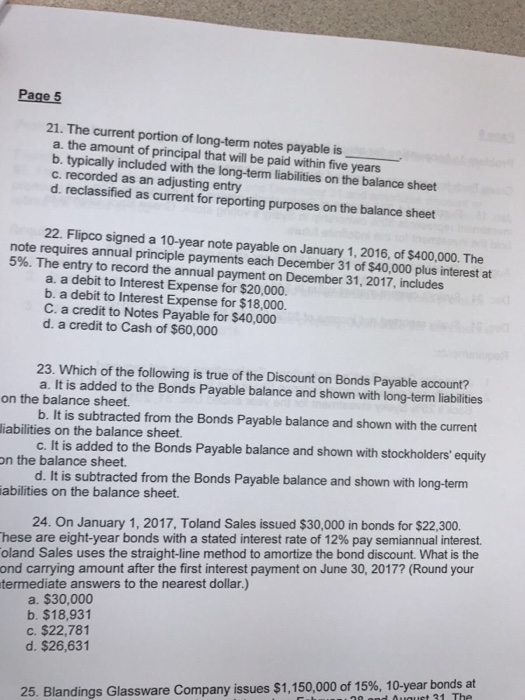

The current portion of long-term notes payable is _____ a. the amount of principal that will be paid within five years b. included with the long-term liabilities on the balance sheet c. recorded an adjusting entry d. reclassified as current for reporting purposes on the balance sheet Flipco signed a 10-year note payable on January 1, 2016, of $400,000.The note requires annual principle payments each December 31 of $40,000 plus interest at 5%. The entry to record the annual payment on December 31, 2017, includes a. a debit to Interest Expense for $20,000. b. a debit to Interest Expense for $18,000. c. a credit to Notes Payable for $40,000 d. a credit to Cash of $60,000 Which of the following is true of the Discount on Bonds Payable account? a. It is added to the Bonds Payable balance and shown with long-term liabilities on the balance sheet. b. It is subtracted from the Bonds Payable balance and shown with the current liabilities on the balance sheet. c. It is added to the Bonds Payable balance and shown with stockholders' equity on the balance sheet. d. It is subtracted from the Bonds Payable balance and shown with long-term abilities on the balance sheet. On January 1, 2017, Toland Sales issued $30,000 in bonds for $22, 300. These are eight-year bonds with a stated interest rate of 12% pay semiannual interest. oland Sales uses the straight-line method to amortize the bond discount. What is the carrying amount after the first interest payment on June 30, 2017? (Round your answers to the nearest dollar.) a. $30,000 b. $18, 931 c. $22, 781 d. $26, 631

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts