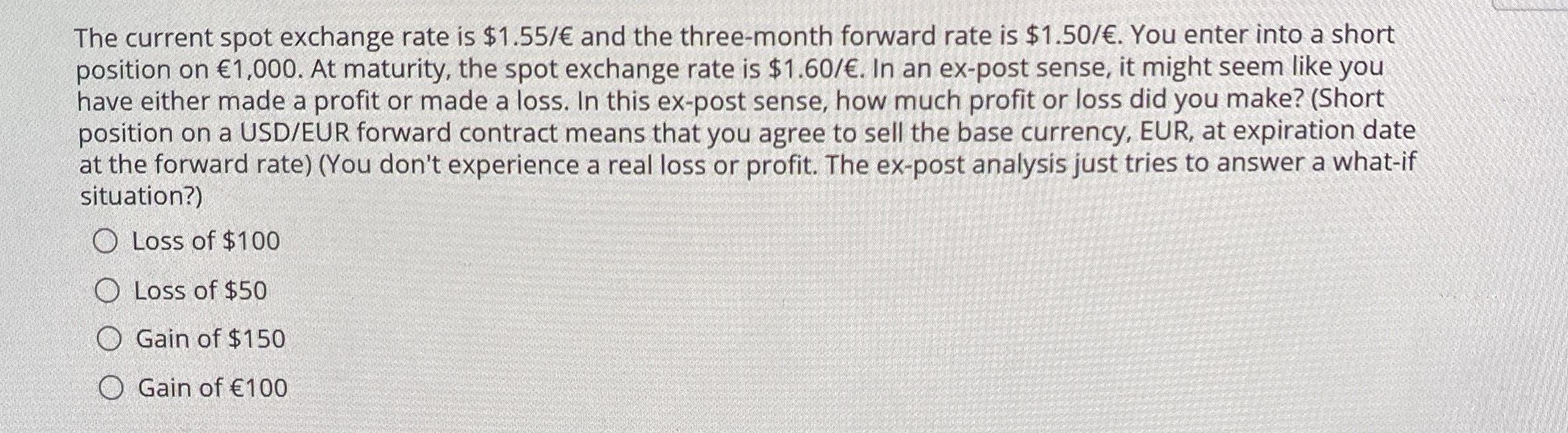

Question: The current spot exchange rate is and the three - month forward rate is . You enter into a short position on . At maturity,

The current spot exchange rate is and the threemonth forward rate is You enter into a short

position on At maturity, the spot exchange rate is In an expost sense, it might seem like you

have either made a profit or made a loss. In this expost sense, how much profit or loss did you make? Short

position on a USDEUR forward contract means that you agree to sell the base currency, EUR, at expiration date

at the forward rateYou don't experience a real loss or profit. The expost analysis just tries to answer a whatif

situation?

Loss of $

Loss of $

Gain of $

Gain of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock