Question: Consider the Black-Scholes-Merton model where the stock price of a (non-dividend- paying) stock (St)t20 with initial spot price So (today at time t =

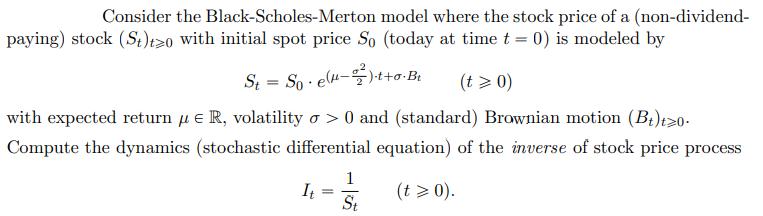

Consider the Black-Scholes-Merton model where the stock price of a (non-dividend- paying) stock (St)t20 with initial spot price So (today at time t = 0) is modeled by St= So e(-2)t+o-Bi (t > 0) with expected return R, volatility o> 0 and (standard) Brownian motion (Bt)t20. Compute the dynamics (stochastic differential equation) of the inverse of stock price process (t > 0). It = 1 St

Step by Step Solution

There are 3 Steps involved in it

SOLUTION To compute the dynamics of the inverse of the stock price process we can use Its Lemma Lets denote the inverse of the stock price process as ... View full answer

Get step-by-step solutions from verified subject matter experts