Question: The data below concerns adjustments to be made at Coffee Bean Importers Adjustments a. On November 1, 2019, the firm signed a lease for a

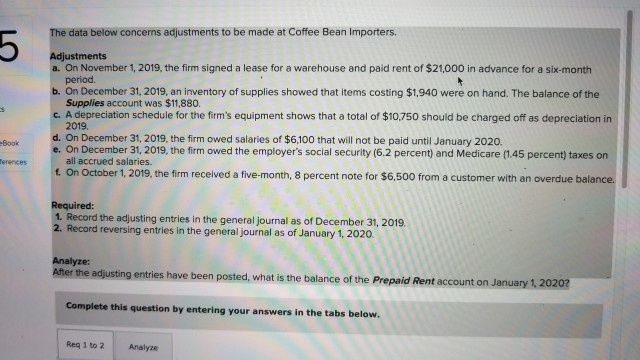

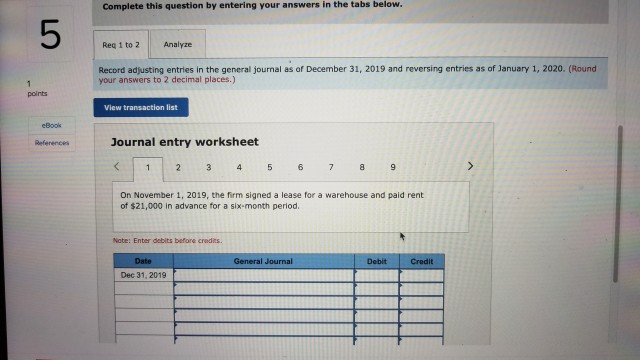

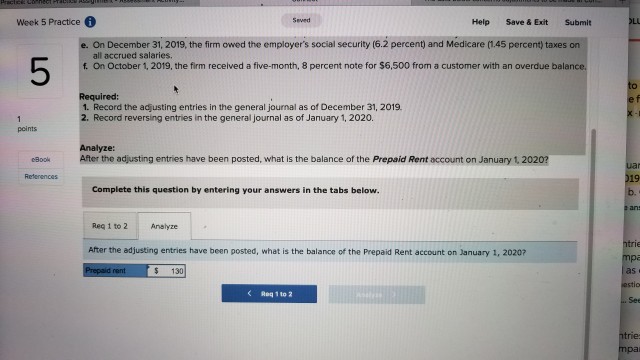

The data below concerns adjustments to be made at Coffee Bean Importers Adjustments a. On November 1, 2019, the firm signed a lease for a warehouse and paid rent of $21,000 in advance for a six-month period. On December 31, 2019, an inventory of supplies showed that items costing $1,940 were on hand. The balance of the Supplies account was $11,880. c. A depreciation schedule for the firm's equipment shows that a total of $10,750 should be charged off as depreciation in 2019 d. On December 31, 2019, the firm owed salaries of $6,100 that will not be paid until January 2020. e. On December 31, 2019, the firm owed the employers social security (6.2 percent) and Medicare (1.45 percent) taxes on Book erences all accrued salaries t. On October 1, 2019, the firm received a five-month, 8 percent note for $6,500 from a customer with an overdue balance. Required: 1. Record the adjusting entries in the general journal as of December 31, 2019. Record reversing entries in the general journal as of January 1, 2020 Analyze After the adjusting entries have been posted, what is the balance of the Prepaid Rent account on January 1 Complete this question by entering your answers in the tabs below. Req 1 to 2 Analyze

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts