Question: the data below shows the comparative balance sheet and income statement for mahal koh incorporated I. Computational Analysis - In each of the problems below,

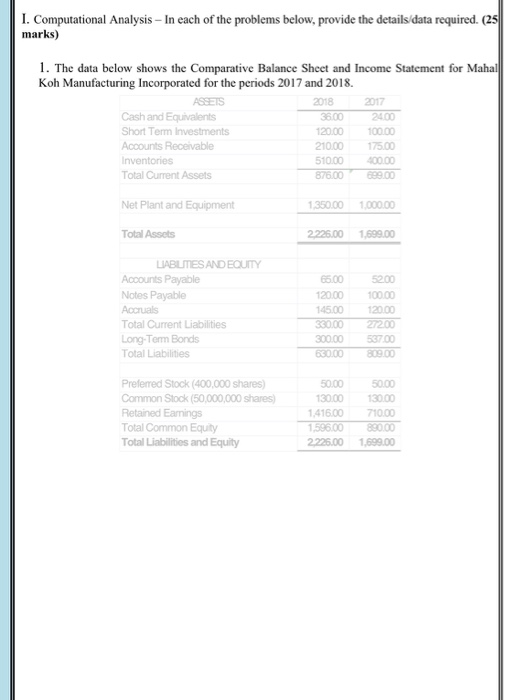

I. Computational Analysis - In each of the problems below, provide the details/data required. (25 marks) 1. The data below shows the Comparative Balance Sheet and Income Statement for Mahal Koh Manufacturing Incorporated for the periods 2017 and 2018. ASSETS 2018 2017 Cash and Equivalents 36.00 2400 Short Term Investments 120.00 10000 Accounts Receivable 210.00 175.00 Inventories 510.00 400.00 Total Current Assets 876.00 699.00 Net Plant and Equipment 1350.00 1.000.00 Total Assets 2225.00 1.699.00 LIABLES AND EQUITY Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term Bonds Total Liabilities 65.00 120.00 145.00 330.00 300.00 630.00 100.00 120.00 27200 537.00 809.00 Preferred Stock (400,000 shares) Common Stock (50,000,000 shares) Retained Earnings Total Common Equity Total Liabilities and Equity 50.00 130.00 1.416.00 1.596.00 2225.00 50.00 130.00 710.00 890.00 1.699.00 I. Computational Analysis - In each of the problems below, provide the details/data required. (25 marks) 1. The data below shows the Comparative Balance Sheet and Income Statement for Mahal Koh Manufacturing Incorporated for the periods 2017 and 2018. ASSETS 2018 2017 Cash and Equivalents 36.00 2400 Short Term Investments 120.00 10000 Accounts Receivable 210.00 175.00 Inventories 510.00 400.00 Total Current Assets 876.00 699.00 Net Plant and Equipment 1350.00 1.000.00 Total Assets 2225.00 1.699.00 LIABLES AND EQUITY Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term Bonds Total Liabilities 65.00 120.00 145.00 330.00 300.00 630.00 100.00 120.00 27200 537.00 809.00 Preferred Stock (400,000 shares) Common Stock (50,000,000 shares) Retained Earnings Total Common Equity Total Liabilities and Equity 50.00 130.00 1.416.00 1.596.00 2225.00 50.00 130.00 710.00 890.00 1.699.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts