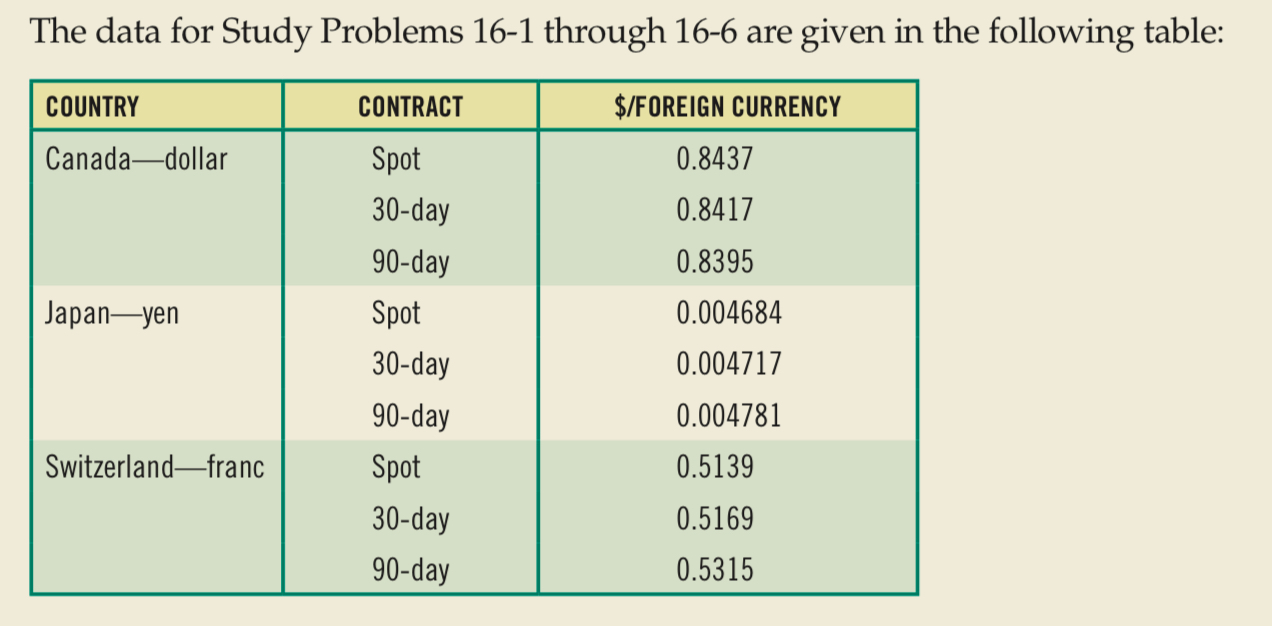

Question: The data for Study Problems 16-1 through 16-6 are given in the following table: 16-2. (Spot exchange rates) An American business needs to pay (a)

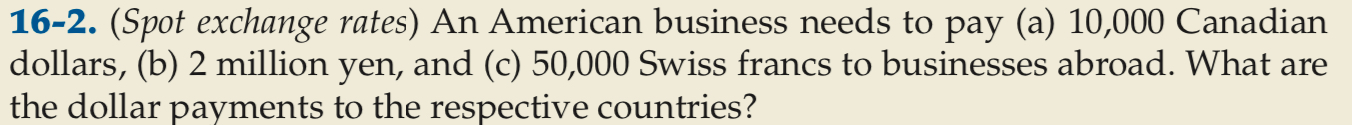

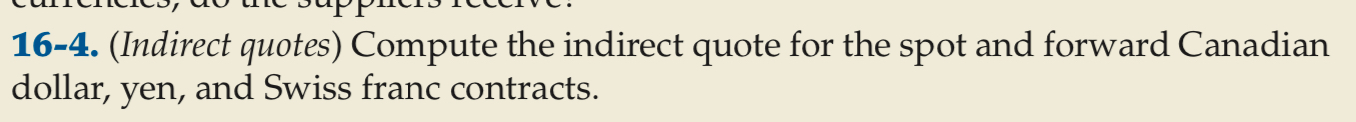

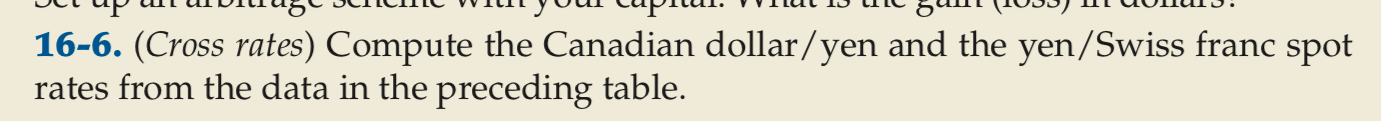

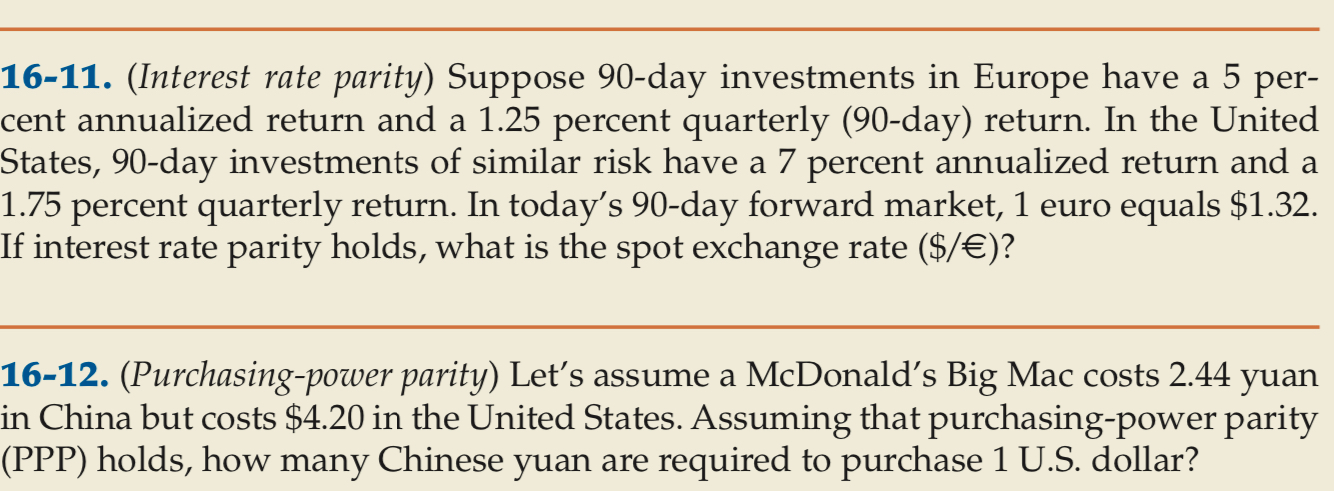

The data for Study Problems 16-1 through 16-6 are given in the following table: 16-2. (Spot exchange rates) An American business needs to pay (a) 10,000 Canadian dollars, (b) 2 million yen, and (c) 50,000 Swiss francs to businesses abroad. What are the dollar payments to the respective countries? 16-4. (Indirect quotes) Compute the indirect quote for the spot and forward Canadian dollar, yen, and Swiss franc contracts. 16-6. (Cross rates) Compute the Canadian dollar/yen and the yen/Swiss franc spot rates from the data in the preceding table. 16-11. (Interest rate parity) Suppose 90-day investments in Europe have a 5 percent annualized return and a 1.25 percent quarterly (90-day) return. In the United States, 90-day investments of similar risk have a 7 percent annualized return and a 1.75 percent quarterly return. In today's 90-day forward market, 1 euro equals $1.32. If interest rate parity holds, what is the spot exchange rate ($/) ? 16-12. (Purchasing-power parity) Let's assume a McDonald's Big Mac costs 2.44 yuan in China but costs $4.20 in the United States. Assuming that purchasing-power parity (PPP) holds, how many Chinese yuan are required to purchase 1 U.S. dollar

Step by Step Solution

There are 3 Steps involved in it

Ive analyzed the images you uploaded They appear to contain the data related to exchange rates and related financial problems including questions on s... View full answer

Get step-by-step solutions from verified subject matter experts