Question: The data in the table below relates to two firms in the same industry, with the same business and operational risk characteristics: Number of equity

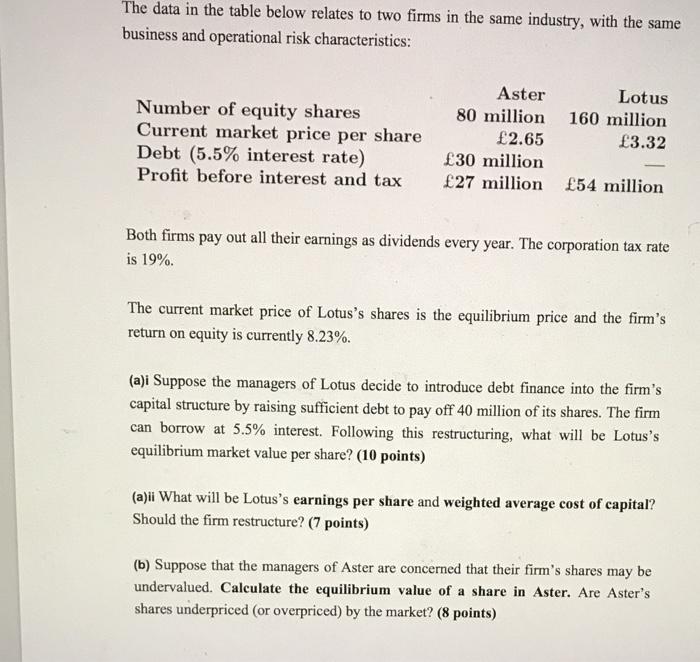

The data in the table below relates to two firms in the same industry, with the same business and operational risk characteristics: Number of equity shares Current market price per share Debt (5.5% interest rate) Profit before interest and tax Aster Lotus 80 million 160 million 2.65 3.32 30 million 27 million 54 million Both firms pay out all their earnings as dividends every year. The corporation tax rate is 19%. The current market price of Lotus's shares is the equilibrium price and the firm's return on equity is currently 8.23%. (a)i Suppose the managers of Lotus decide to introduce debt finance into the firm's capital structure by raising sufficient debt to pay off 40 million of its shares. The firm can borrow at 5.5% interest. Following this restructuring, what will be Lotus's equilibrium market value per share? (10 points) (a)il What will be Lotus's earnings per share and weighted average cost of capital? Should the firm restructure? (7 points) (b) Suppose that the managers of Aster are concerned that their firm's shares may be undervalued. Calculate the equilibrium value of a share in Aster. Are Aster's shares underpriced (or overpriced) by the market? (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts