Question: the data u can put whatever you can find the 5 stocks are amazon intel ibm walmart netflix Question 2: (2 points) Calculate systematic risks

the data u can put whatever you can find

the 5 stocks are amazon intel ibm walmart netflix

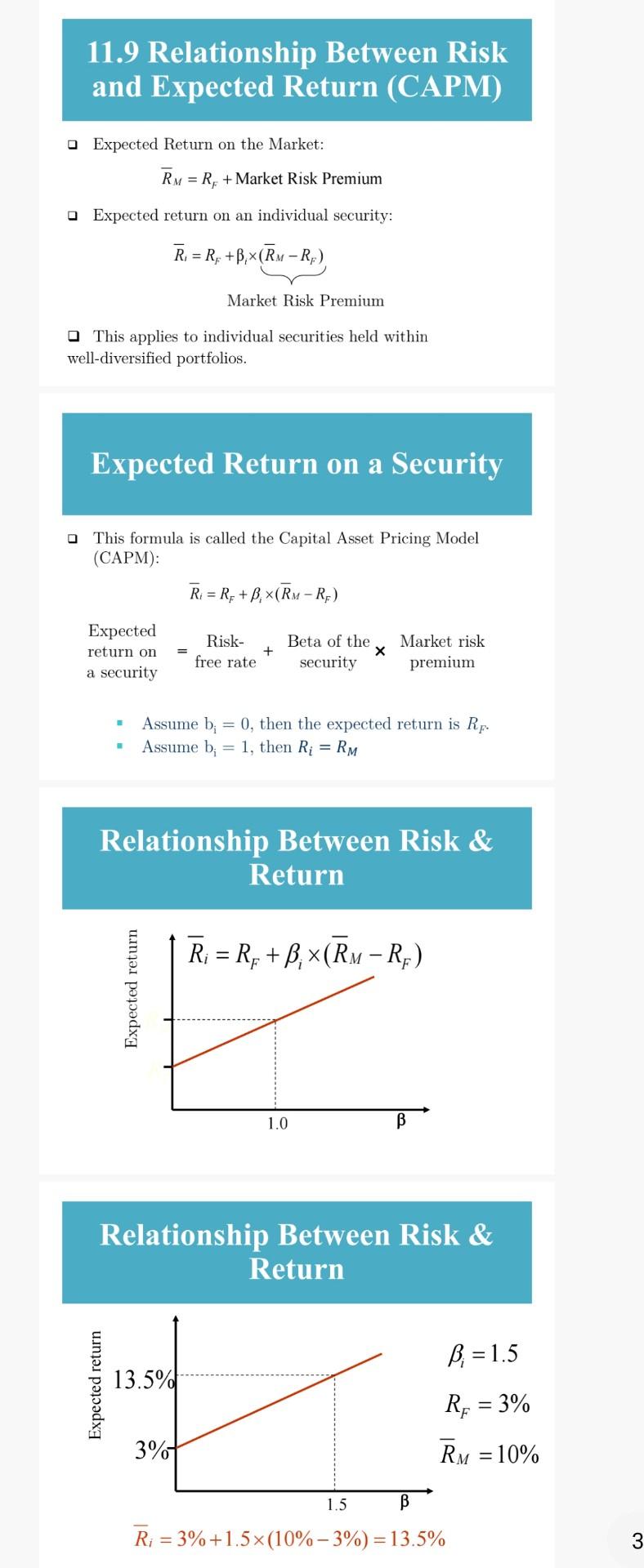

Question 2: (2 points) Calculate systematic risks (i.e., betas) of each of the 5 stocks using Capital Asset Pricing Model (CAPM) in Excel. 11.9 Relationship Between Risk and Expected Return (CAPM) Expected Return on the Market: RM=RF+ Market Risk Premium Expected return on an individual security: Ri=RF+i(RMRF) Market Risk Premium - This applies to individual securities held within well-diversified portfolios. Expected Return on a Security This formula is called the Capital Asset Pricing Model (CAPM): Ri=RF+i(RMRF) Expected returnonasecurity=freerate+BetaofthesecurityMarketriskpremium - Assume bi=0, then the expected return is RF. - Assume bi=1, then Ri=RM Relationship Between Risk \& Return Question 2: (2 points) Calculate systematic risks (i.e., betas) of each of the 5 stocks using Capital Asset Pricing Model (CAPM) in Excel. 11.9 Relationship Between Risk and Expected Return (CAPM) Expected Return on the Market: RM=RF+ Market Risk Premium Expected return on an individual security: Ri=RF+i(RMRF) Market Risk Premium - This applies to individual securities held within well-diversified portfolios. Expected Return on a Security This formula is called the Capital Asset Pricing Model (CAPM): Ri=RF+i(RMRF) Expected returnonasecurity=freerate+BetaofthesecurityMarketriskpremium - Assume bi=0, then the expected return is RF. - Assume bi=1, then Ri=RM Relationship Between Risk \& Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts