Question: The decedent devised to his four (4) children separate parcels of land with the following data: TO JUAN, 1,000 square meter lot in Sampaloc, Manila

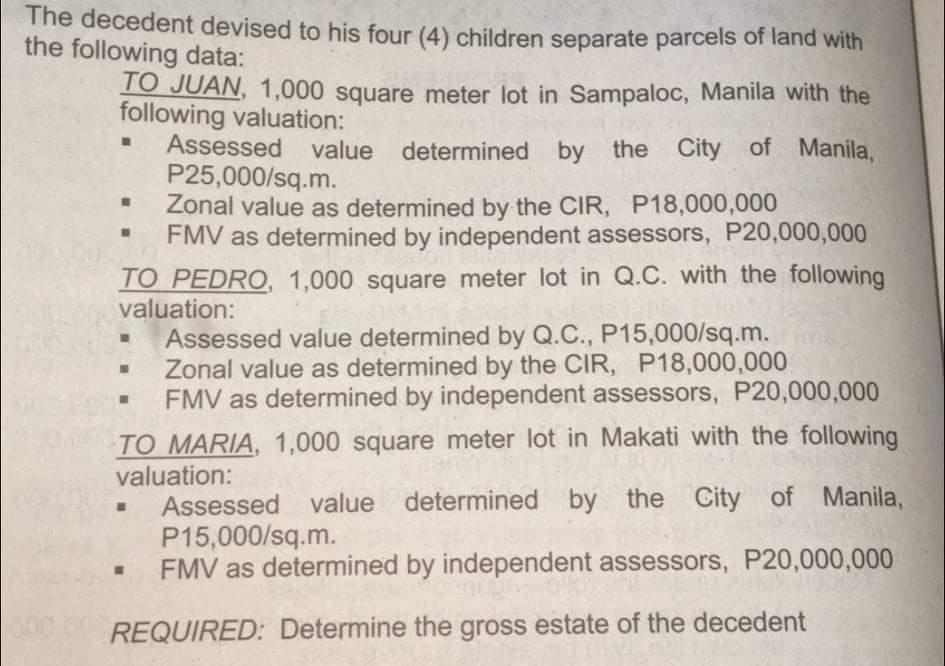

The decedent devised to his four (4) children separate parcels of land with the following data: TO JUAN, 1,000 square meter lot in Sampaloc, Manila with the following valuation: Assessed value determined by the City of Manila, P25,000/sq.m. Zonal value as determined by the CIR, P18,000,000 FMV as determined by independent assessors, P20,000,000 TO PEDRO, 1,000 square meter lot in Q.C. with the following valuation: Assessed value determined by Q.C., P15,000/sq.m. Zonal value as determined by the CIR, P18,000,000 FMV as determined by independent assessors, P20,000,000 TO MARIA, 1,000 square meter lot in Makati with the following valuation: Assessed value determined by the City of Manila, by the P15,000/sq.m. FMV as determined by independent assessors, P20,000,000 . REQUIRED: Determine the gross estate of the decedent The decedent devised to his four (4) children separate parcels of land with the following data: TO JUAN, 1,000 square meter lot in Sampaloc, Manila with the following valuation: Assessed value determined by the City of Manila, P25,000/sq.m. Zonal value as determined by the CIR, P18,000,000 FMV as determined by independent assessors, P20,000,000 TO PEDRO, 1,000 square meter lot in Q.C. with the following valuation: Assessed value determined by Q.C., P15,000/sq.m. Zonal value as determined by the CIR, P18,000,000 FMV as determined by independent assessors, P20,000,000 TO MARIA, 1,000 square meter lot in Makati with the following valuation: Assessed value determined by the City of Manila, by the P15,000/sq.m. FMV as determined by independent assessors, P20,000,000 . REQUIRED: Determine the gross estate of the decedent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts