Question: The decision on capital budgeting using the NPV method may be at risk of being a wrong decision if it is based on inaccurate estimates

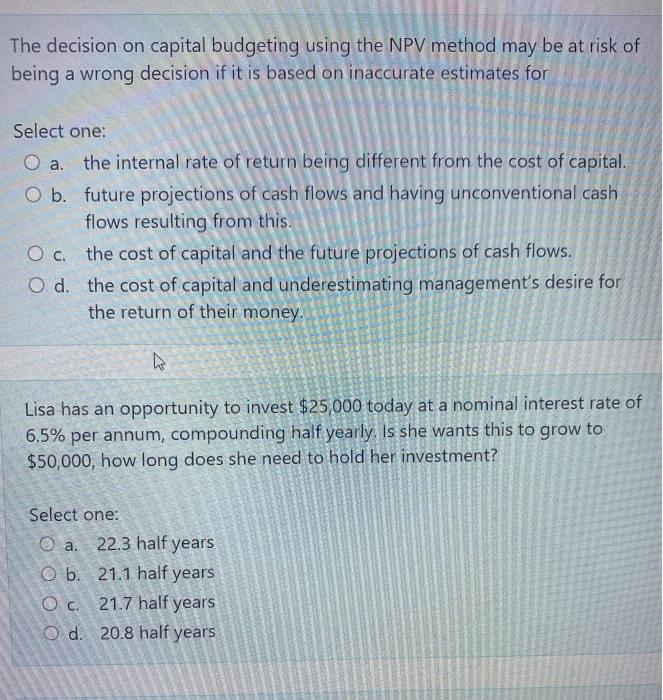

The decision on capital budgeting using the NPV method may be at risk of being a wrong decision if it is based on inaccurate estimates for Select one: O a. the internal rate of return being different from the cost of capital. O b. future projections of cash flows and having unconventional cash flows resulting from this. Oc. the cost of capital and the future projections of cash flows. Od the cost of capital and underestimating management's desire for the return of their money. Lisa has an opportunity to invest $25,000 today at a nominal interest rate of 6.5% per annum, compounding half yearly. Is she wants this to grow to $50,000, how long does she need to hold her investment? Select one: O a. 22.3 half years O b. 21.1 half years O c. 21.7 half years O d. 20.8 half years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts