Question: The declaration, record, and payment dates in connection with a cash dividend of $115,900 on a corporation's common stock are January 12, March 13, and

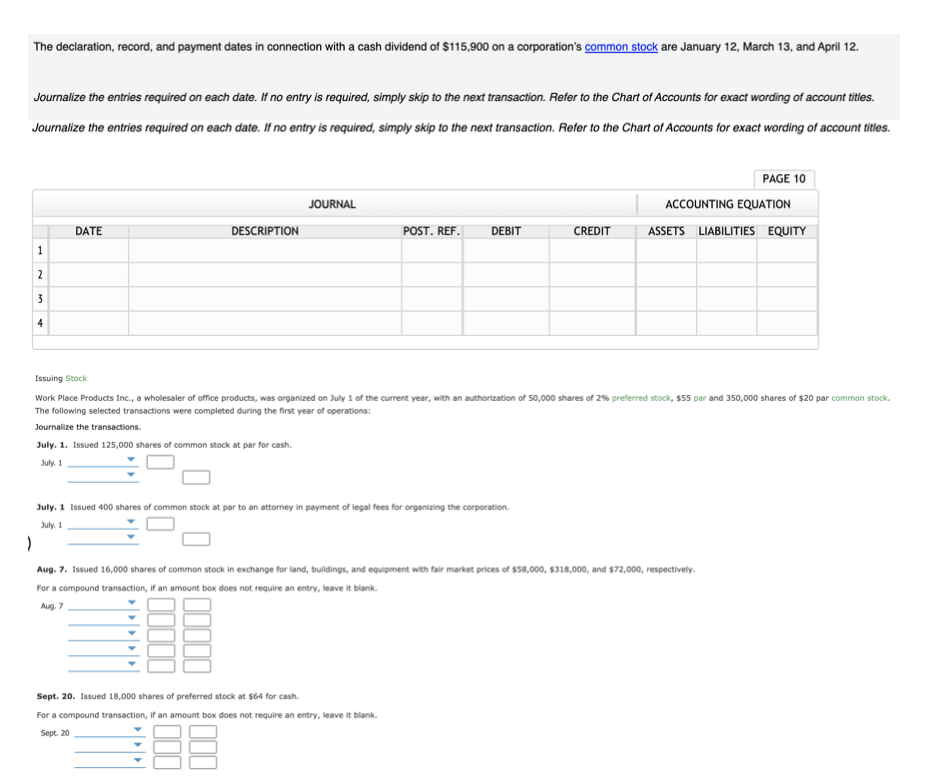

The declaration, record, and payment dates in connection with a cash dividend of $115,900 on a corporation's common stock are January 12, March 13, and April 12. Journalize the entries required on each date. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles. Journalize the entries required on each date. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles. PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Issuing Stock Work Place Products Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 50,000 shares of 2% preferred stock, $55 par and 350,000 shares of $20 par common stock. The following selected transactions were completed during the first year of operations: Journalize the transactions. July. 1. Issued 125,000 shares of common stock at par for cash. July 1 July 1 Issued 400 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation July 1 Aug. 7. Issued 16,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $58,000, $318,000, and $72,000, respectively, For a compound transaction, if an amount box does not require an entry, leave it blank. Aug. 7 Sept. 20. Issued 18,000 shares of preferred stock at $64 for cash. For a compound transaction, if an amount box does not require an entry, leave it blank. Sept. 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts