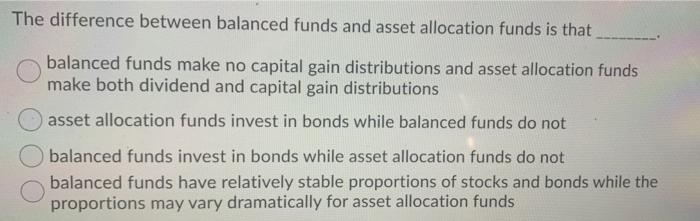

Question: The difference between balanced funds and asset allocation funds is that balanced funds make no capital gain distributions and asset allocation funds make both dividend

The difference between balanced funds and asset allocation funds is that balanced funds make no capital gain distributions and asset allocation funds make both dividend and capital gain distributions asset allocation funds invest in bonds while balanced funds do not balanced funds invest in bonds while asset allocation funds do not balanced funds have relatively stable proportions of stocks and bonds while the proportions may vary dramatically for asset allocation funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts