Question: The Difference between both the method computed under l(b) and 2(b) is $33,920 -S21,750 $12,170. It means that If the company used the single rate

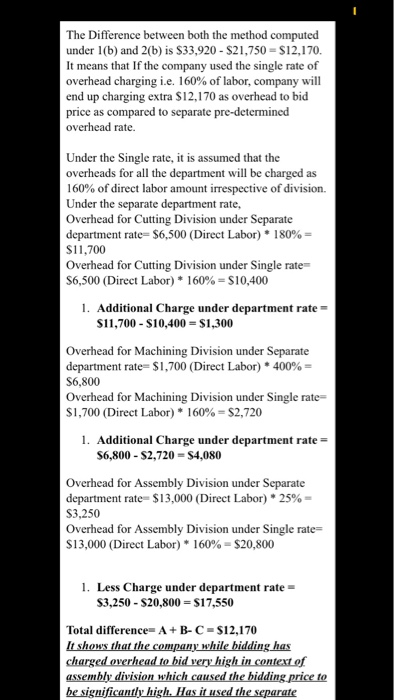

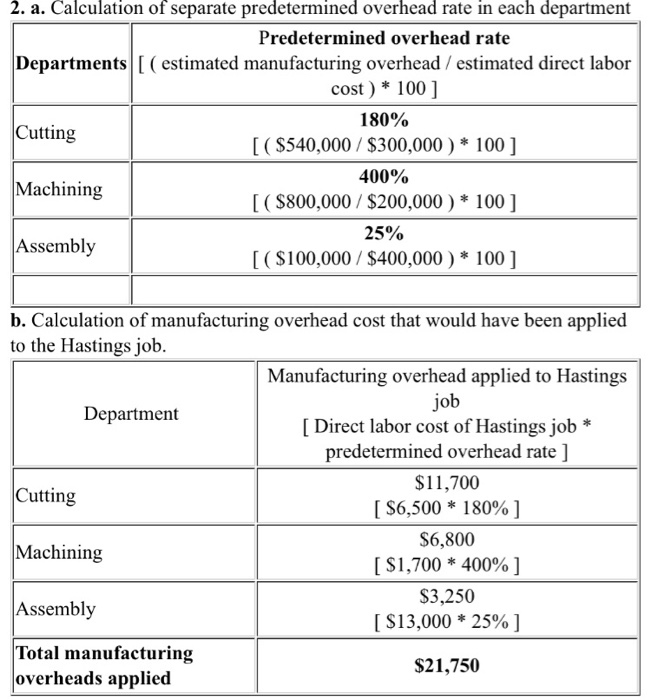

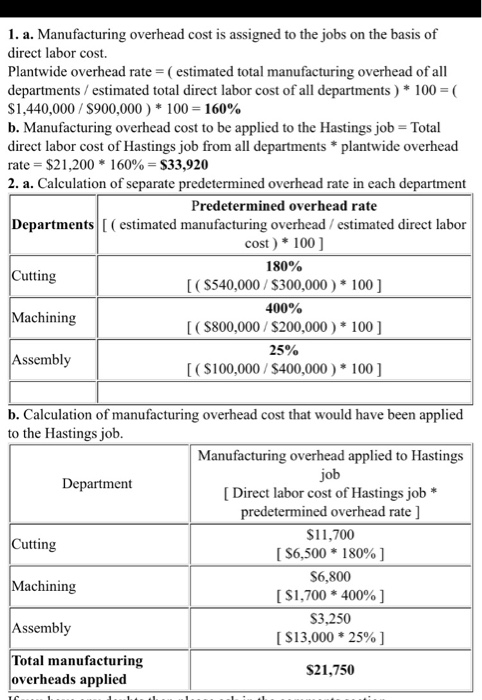

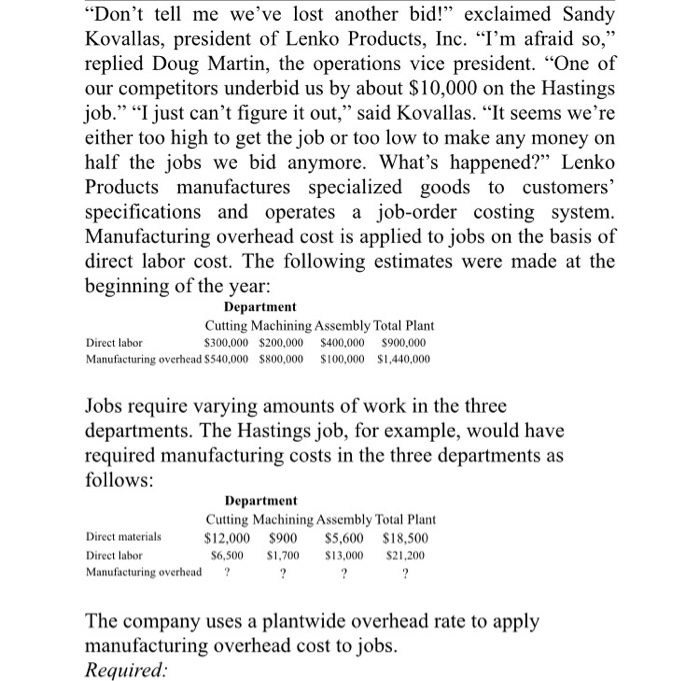

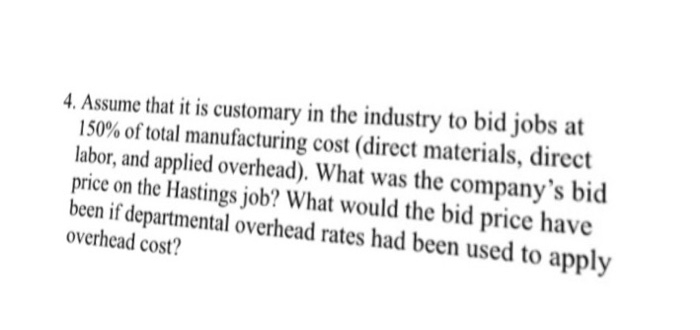

The Difference between both the method computed under l(b) and 2(b) is $33,920 -S21,750 $12,170. It means that If the company used the single rate of overhead charging i.e. 160% of labor, company will end up charging extra $12,170 as overhead to bid price as compared to separate pre-determined overhead rate. Under the Single rate, it is assumed that the overheads for all the department will be charged as 160% of direct labor amount irrespective of division. Under the separate department rate, Overhead for Cutting Division under Separate department rte-$6,500 (Direct Labor) * 180% S11,700 Overhead for Cutting Division under Single rate S6,500 (Direct Labor) * 160% $10,400 1. Additional Charge under department rate S11,700 -$10,400-$1,300 Overhead for Machining Division under Separate department rate: $1,700 (Direct Labor) * 400% S6,800 Overhead for Machining Division under Single rate- $1,700 (Direct Labor) * 160% $2,720 1. Additional Charge under department rate 56.800-$2,720-$4,080 Overhead for Assembly Division under Separate department rate: $13,000 (Direct Labor) * 25% S3,250 Overhead for Assembly Division under Single rate- $13,000 (Direct Labor) * 160%-$20,800 1. Less Charge under department rate- S3,250 - S20,800 S17,550 Total difference. A + B-C $12,170

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts