Question: The difference between the market's expected return and the risk-free rate is the: a. realized return b. market risk premium. c. future risk premium. d.

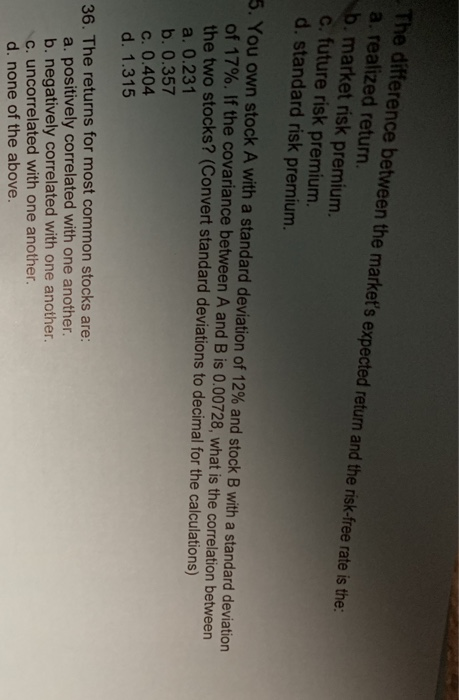

The difference between the market's expected return and the risk-free rate is the: a. realized return b. market risk premium. c. future risk premium. d. standard risk premium. 5. You own stock A with a standard deviation of 12% and stock B with a standard deviation of 17%. If the covariance between A and B is 0.00728, what is the correlation between the two stocks? (Convert standard deviations to decimal for the calculations) a. 0.231 b. 0.357 c. 0.404 d. 1.315 36. The returns for most common stocks are: a. positively correlated with one another. b. negatively correlated with one another. c. uncorrelated with one another. d. none of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock