Question: The differences between the unadjusted and adjusted trial balances can be explained by adjusting entries that were made for an unrecorded sale, depreciation, expired insurance,

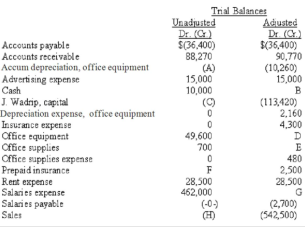

The differences between the unadjusted and adjusted trial balances can be explained by adjusting entries that were made for an unrecorded sale, depreciation, expired insurance, office supplies expense, and accrued salaries expense. Determine the amounts that should appear in the trial balance blanks labeled A through H and write your answers below. (Show credit amounts in parentheses.) [8] A. ____________ B. ___________ C. ____________ D. ____________ E. ____________ F. ___________ G. ____________ H. ____________

(A) Accounts payable Accounts receivable Accum depreciation office equipment Advertising expense Cash J. Wadrip, Capital Depreciation expense, office equipment Insurance expense Office equipment Office supplies Office supplies expense Prepaid insurance Rent expense Salaries expense Salaries payable Sales Trial Balances Unadjusted Adusted Dr.) Dr. (C) $(36.400) (36,400) 88,270 90,770 (10,260) 15,000 15,000 10,000 B ( (113.420) 0 2.160 0 4.300 49,600 D 700 E 0 480 F F 2,500 28,500 28.500 462,000 G (-01 (2.700) (H) (542,500)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts