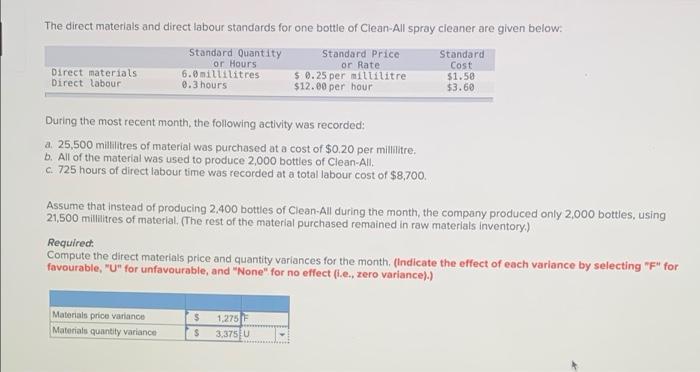

Question: The direct materials and direct labour standards for one bottle of Clean-All spray cleaner are given below: Standard Quantity Standard Price Standard or Hours or

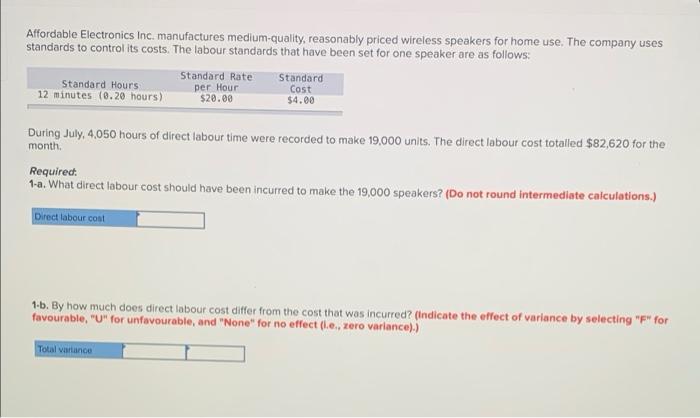

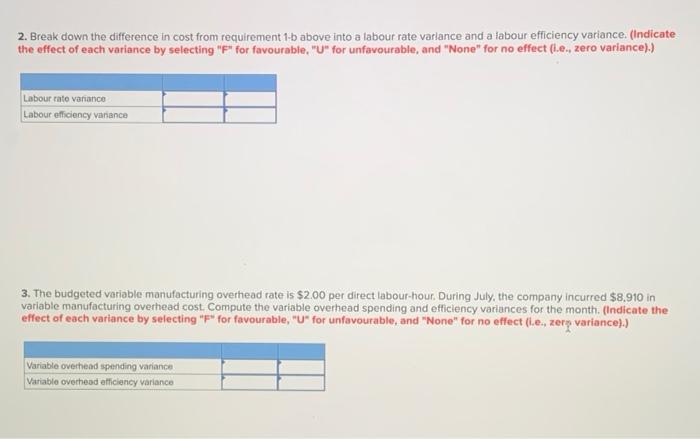

The direct materials and direct labour standards for one bottle of Clean-All spray cleaner are given below: Standard Quantity Standard Price Standard or Hours or Rate Cost Direct materials 6.0 millilitres $ 0.25 per millilitre $1.50 Direct labour 0.3 hours $12.00 per hour $3.60 During the most recent month, the following activity was recorded: a. 25,500 millilitres of material was purchased at a cost of $0.20 per militre b. All of the material was used to produce 2,000 bottles of Clean-All. c. 725 hours of direct labour time was recorded at a total labour cost of $8,700. Assume that Instead of producing 2.400 bottles of Clean-All during the month, the company produced only 2,000 bottles, using 21,500 millilitres of material, (The rest of the material purchased remained in raw materials inventory:) Required Compute the direct materials price and quantity variances for the month, (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (.e., zero variance).) Materials price variance Materials quantity variance $ $ 1,275 3.375 U Affordable Electronics Inc. manufactures medium-quality, reasonably priced wireless speakers for home use. The company uses standards to control its costs. The labour standards that have been set for one speaker are as follows: Standard Rate Standard Standard Hours per Hour Cost 12 minutes 18.20 hours) $4.00 $20.00 During July, 4.050 hours of direct labour time were recorded to make 19,000 units. The direct labour cost totalled $82,620 for the month Required: 1-a. What direct labour cost should have been incurred to make the 19,000 speakers? (Do not round intermediate calculations.) Direct labour cont 1-b. By how much does direct labour cost differ from the cost that was incurred? (Indicate the effect of variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (le, zero variance).) Total variance 2. Break down the difference in cost from requirement 1-b above into a labour rate variance and a labour efficiency variance. (Indicate the effect of each variance by selecting "P" for favourable. "U" for unfavourable, and "None" for no effect (i.e., zero variance).) Labour rate variance Labour efficiency variance 3. The budgeted variable manufacturing overhead rate is $2.00 per direct labour-hour. During July, the company incurred $8.910 in variable manufacturing overhead cost. Compute the variable overhead spending and efficiency variances for the month. (Indicate the effect of each variance by selecting "P" for favourable, "U" for unfavourable, and "None" for no effect (ie, zery variance).) Variable overhead spending variance Variable overhead efficiency variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts