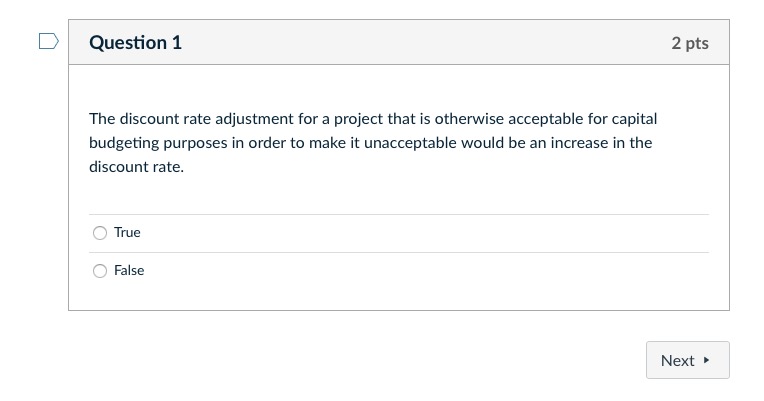

Question: _ The discount rate adjustment for a project that is otherwise acceptable for capital budgeting purposes in order to make it unacceptable would be an

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock