Question: The distributed earnings is $ (Round to the nearest dollar.) Complete the statement of retained earnings: (Round to the nearest dollar.) Statement of retained earnings.

The distributed earnings is

$

(Round to the nearest dollar.)

Complete the statement of retained earnings:

(Round to the nearest dollar.)

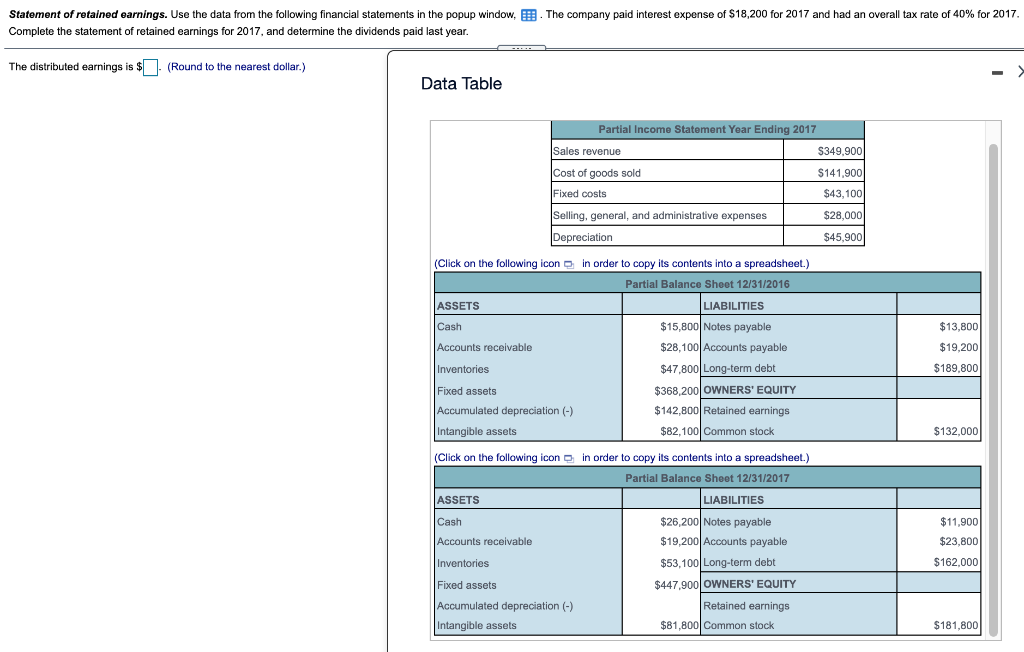

Statement of retained earnings. Use the data from the following financial statements in the popup window, B. The company paid interest expense of $18,200 for 2017 and had an overall tax rate of 40% for 2017 Complete the statement of retained earnings for 2017, and determine the dividends paid last year. The distributed earnings is $(Round to the nearest dollar.) Data Table Partial Income Statement Year Ending 2017 Sales revenue $349,900 Cost of goods sold $141,900 Fixed costs $43, 100 Selling, general, and administrative expenses $28,0001 Depreciation $45,900 $13,800 (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2016 ASSETS LIABILITIES Cash $15,800 Notes payable Accounts receivable $28,100 Accounts payable Inventories $47,800 Long-term debt Fixed assets $368,200 OWNERS' EQUITY Accumulated depreciation (-) $142,800 Retained earnings Intangible assets $82,100 Common stock $19,200 $189,800 $132,000 $11,900 (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2017 ASSETS LIABILITIES Cash $26,200 Notes payable Accounts receivable $19,200 Accounts payable Inventories $53,100 Long-term debt Fixed assets $447,900 OWNERS' EQUITY Accumulated depreciation (-) Retained earnings Intangible assets $81,800| Common stock $23,800 $162,000 $181,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts