Question: The Dividend - Discount Model offers a simple framework for understanding movements in the stock market. The equation associated with the Dividend - Discount model

The DividendDiscount Model offers a simple framework for understanding movements in the stock market. The equation associated with the DividendDiscount model is the following:

where is the riskfree rate rf plus the risk premium rp

What does the dividenddiscount model assume about the growth rate of dividends?

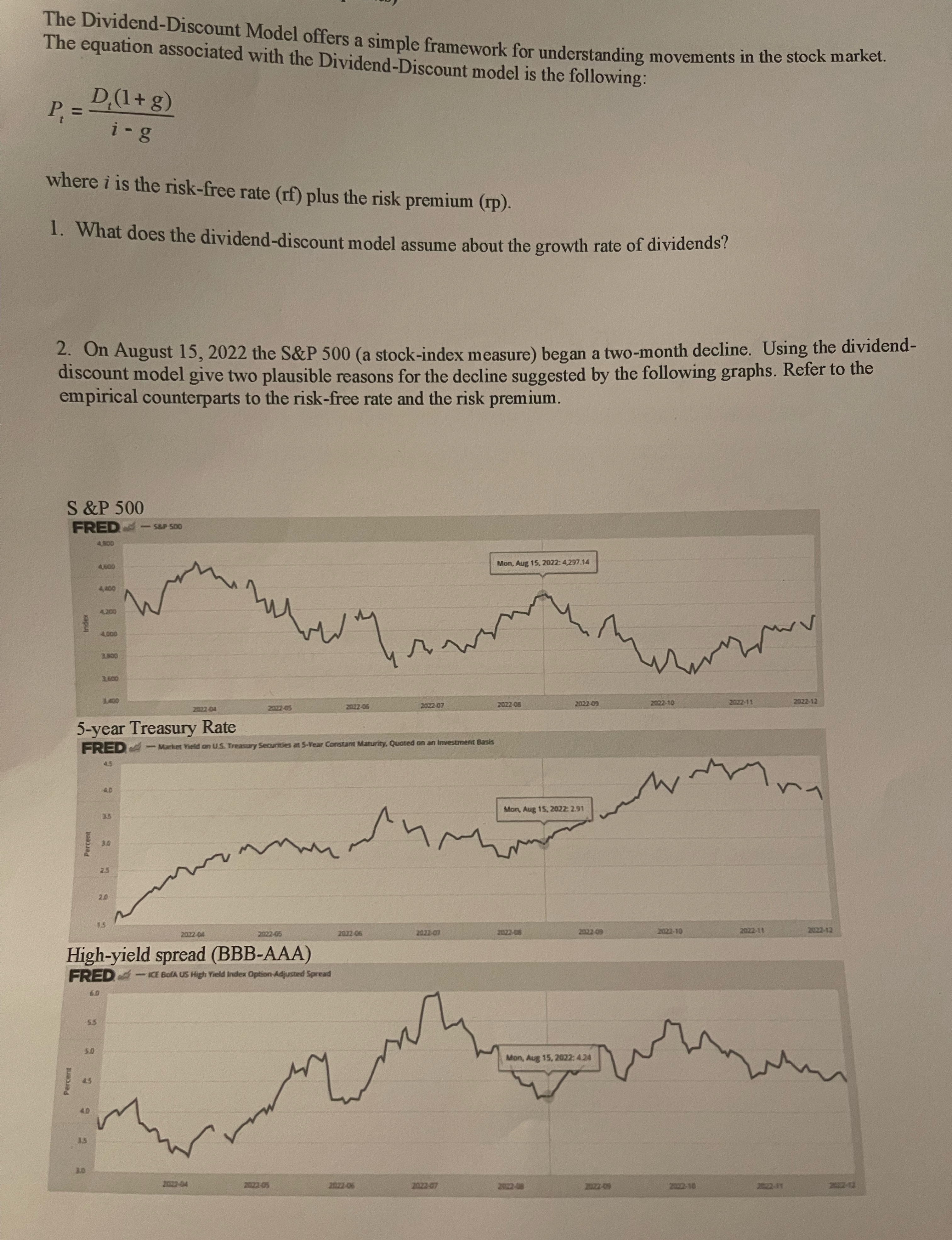

On August the S&P a stockindex measure began a twomonth decline. Using the dividenddiscount model give two plausible reasons for the decline suggested by the following graphs. Refer to the empirical counterparts to the riskfree rate and the risk premium.

year Treasury Rate

Highyield spread BBBAAA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock