Question: The double-declining -balance method is to be used for an asset with a cost of $42000, salvage value of $6000 and an estimated useful life

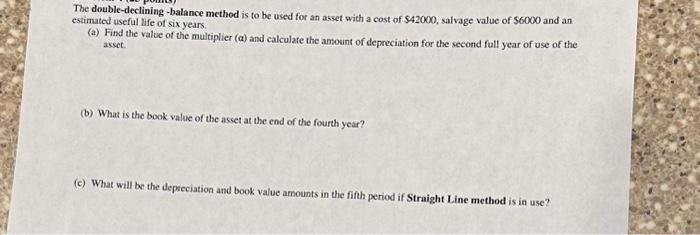

The double-declining -balance method is to be used for an asset with a cost of $42000, salvage value of $6000 and an estimated useful life of six years. (a) Find the value of the multiplier () and calculate the amount of depreciation for the second full year of use of the asset. (b) What is the book value of the asset at the end of the fourth year? (c) What will be the depreciation and book value amounts in the fifth period if Straight Line method is in use

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock