Question: The drop downs are rises/declines and should/should not. Problem 11-09 The dividend-growth model, Do(1+g) V= k - 9 suggests that an increase in the dividend

The drop downs are rises/declines and should/should not.

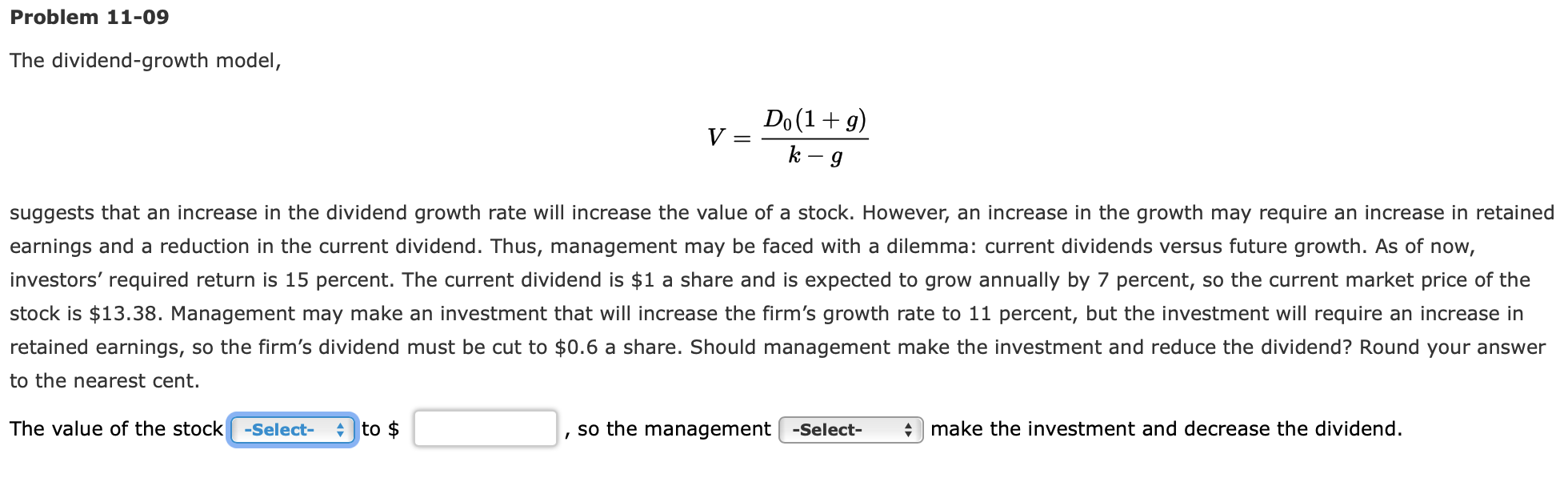

Problem 11-09 The dividend-growth model, Do(1+g) V= k - 9 suggests that an increase in the dividend growth rate will increase the value of a stock. However, an increase in the growth may require an increase in retained earnings and a reduction in the current dividend. Thus, management may be faced with a dilemma: current dividends versus future growth. As of now, investors' required return is 15 percent. The current dividend is $1 a share and is expected to grow annually by 7 percent, so the current market price of the stock is $13.38. Management may make an investment that will increase the firm's growth rate to 11 percent, but the investment will require an increase in retained earnings, so the firm's dividend must be cut to $0.6 a share. Should management make the investment and reduce the dividend? Round your answer to the nearest cent. The value of the stock -Select- 4 to $ so the management -Select- A make the investment and decrease the dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts