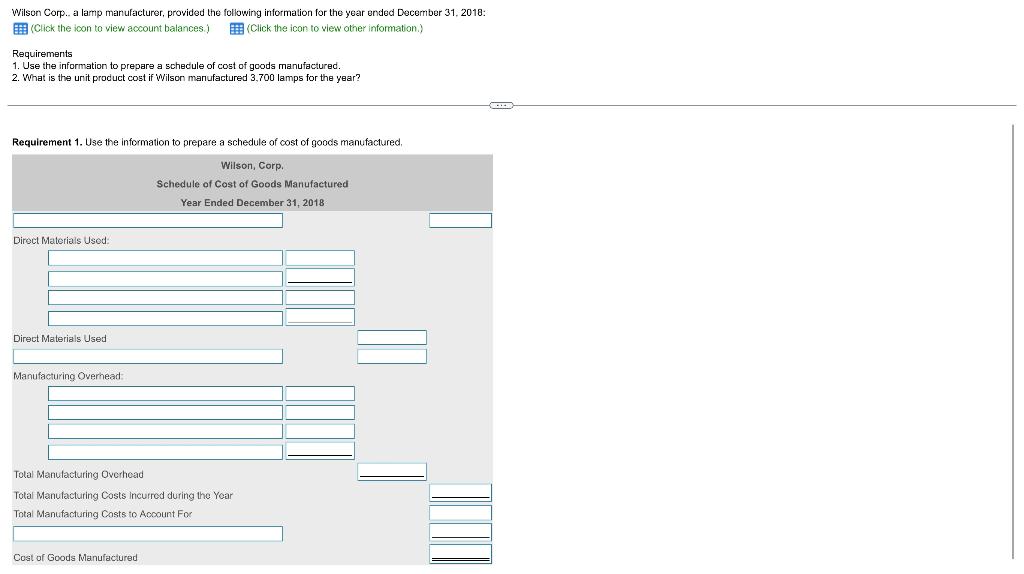

Question: The drop downs: beginning direct materials, beginning work-in-progress inventory, depreciation plant building equipment, direct labor, direct materials available for use, ending direct materials, ending work-in-progress

The drop downs: beginning direct materials, beginning work-in-progress inventory, depreciation plant building equipment, direct labor, direct materials available for use, ending direct materials, ending work-in-progress inventory, indirect labor, insurance on plant, purchases of direct materials, repairs and maintenance-plant

Wilson Corp.. a lamp manufacturer, provided the following information for the year ended December 31, 2018: (Click the icon to view account balances.) (Click the icon to view other information.) Requirements 1. Use the information to prepare a schedule of cost of goods manufactured. 2. What is the unit product cost if Wilson manufactured 3.700 lamps for the year? Requirement 1. Use the information to prepare a schedule of cost of goods manufactured, Wilson, Corp. Schedule of Cost of Goods Manufactured Year Ended December 31, 2018 Direct Materials Used: Direct Materials Used Manufacturing Overhead: Total Manufacturing Overhead Total Manufacturing Costs incurred during the Year Total Manufacturing Costs to Account For Cost Goods Manufactured C Wilson Corp.. a lamp manufacturer, provided the following information for the year ended December 31, 2018: (Click the icon to view account balances.) (Click the icon to view other information.) Requirements 1. Use the information to prepare a schedule of cost of goods manufactured. 2. What is the unit product cost if Wilson manufactured 3.700 lamps for the year? Requirement 1. Use the information to prepare a schedule of cost of goods manufactured, Wilson, Corp. Schedule of Cost of Goods Manufactured Year Ended December 31, 2018 Direct Materials Used: Direct Materials Used Manufacturing Overhead: Total Manufacturing Overhead Total Manufacturing Costs incurred during the Year Total Manufacturing Costs to Account For Cost Goods Manufactured C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts