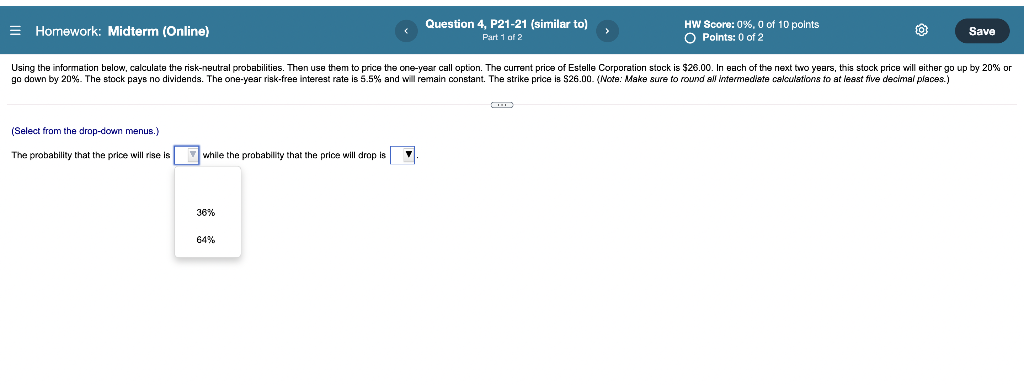

Question: the dropdown menu options for both boxes are 36% and 64% p d Homework: Midterm (Online) Question 4, P21-21 (similar to) Part 1 of 3

the dropdown menu options for both boxes are 36% and 64%  p d

p d

Homework: Midterm (Online) Question 4, P21-21 (similar to) Part 1 of 3 > HW Score: 0%, 0 of 10 points O Points: 0 of 2 Save Using the information below, calculate the risk-neutral probabilities. Then use them to price the one-year call option. The current price of Estelle Corporation stock is $26.00. In each of the next two years, this stock price will either go up by 20% or go down by 20%. The stock pays no dividends. The one-year risk-free interest rate is 5.5% and will remain constant. The strike price is $26.00. (Note: Make sure to round all intermediate calculations to at least five decimal places.) (Select from the drop-down menus.) The probability that the price will rise is while the probability that the price will drop is 7 36% 64%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts