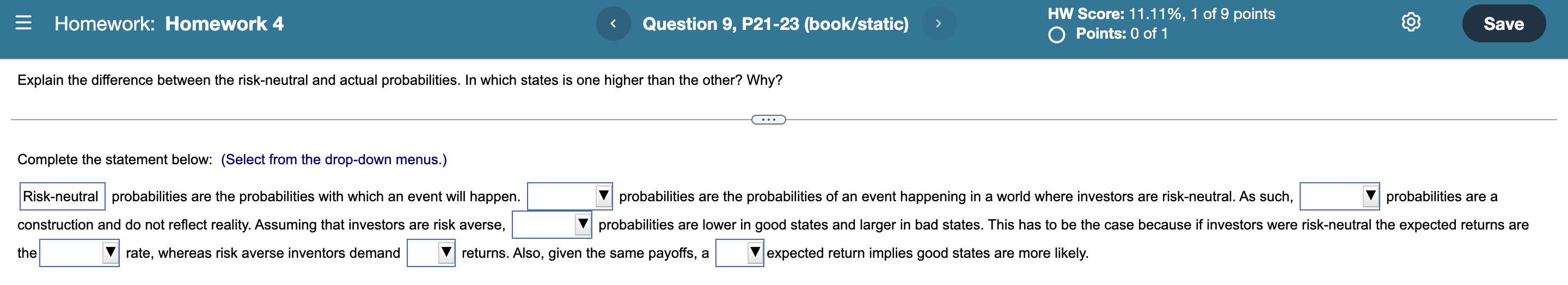

Question: The drop-down options for the first two lines are the same, they are Risk-neutral and actual. From the third line, the first box's option is

The drop-down options for the first two lines are the same, they are "Risk-neutral" and "actual". From the third line, the first box's option is : "risk-free" and "risk-neutral". Second box options are "higher" and "lower". For the third box options are also "higher" and "lower"

The drop-down options for the first two lines are the same, they are "Risk-neutral" and "actual". From the third line, the first box's option is : "risk-free" and "risk-neutral". Second box options are "higher" and "lower". For the third box options are also "higher" and "lower"

Homework: Homework 4 HW Score: 11.11%, 1 of 9 points O Points: 0 of 1 Save Explain the difference between the risk-neutral and actual probabilities. In which states is one higher than the other? Why? Complete the statement below: (Select from the drop-down menus.) Risk-neutral probabilities are the probabilities with which an event will happen. probabilities are the probabilities of an event happening in a world where investors are risk-neutral. As such, probabilities are a construction and do not reflect reality. Assuming that investors are risk averse, probabilities are lower in good states and larger in bad states. This has to be the case because if investors were risk-neutral the expected returns are the rate, whereas risk averse inventors demand returns. Also, given the same payoffs, a expected return implies good states are more likely. Homework: Homework 4 HW Score: 11.11%, 1 of 9 points O Points: 0 of 1 Save Explain the difference between the risk-neutral and actual probabilities. In which states is one higher than the other? Why? Complete the statement below: (Select from the drop-down menus.) Risk-neutral probabilities are the probabilities with which an event will happen. probabilities are the probabilities of an event happening in a world where investors are risk-neutral. As such, probabilities are a construction and do not reflect reality. Assuming that investors are risk averse, probabilities are lower in good states and larger in bad states. This has to be the case because if investors were risk-neutral the expected returns are the rate, whereas risk averse inventors demand returns. Also, given the same payoffs, a expected return implies good states are more likely

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts