Question: The due date for this comprehensive problem is Wednesday, November 2 0 , 2 0 2 4 . You are to email your answer which

The due date for this comprehensive problem is Wednesday, November You are to email your answer which should include a completed consolidation worksheet, consolidation entries including an explanation line, a consolidated income statement, and a consolidated balance sheet for This is a point exercise. You are to work individually on this problem and to have no assistance. You may use your textbook and notes. It covers accounting issues from chapters through The problem includes a fact pattern presented below and an Excel spreadsheet containing the financial statements of Mack Corp the Parent and KappCo the Subsidiary The problem should be prepared on Excel spreadsheets If you have any questions or need any clarification, please contact me Good luck!

Mack Corp, a closelyheld manufacturer having a calendar yearend, searched for a vendor to provide it with a supply of quality widgets for its production facility. It had done business with KappCo for several years, and an opportunity to acquire the vendor was eagerly consummated. Mack Corp purchased percent of KappCo on January for $ in cash. On that date, the percent noncontrolling interest was appraised to have a $ fair value. On the date of acquisition, KappCo had a book value of $ Also at the acquisition date, KappCo held equipment fouryear remaining life undervalued in its financial records by $; interestbearing liabilities fiveyear remaining life overvalued by $; and the remainder of the excess of fair value over book value was assigned to previously unrecognized brand names trade marks with a fair value of $ and an estimated year life. Mack uses the initial value method for accounting for its investment in KappCo.

Mack Corp sold KappCo an old building and lot on January On the date of the sale, the land on Macks books was valued at $ and had a sale value of $ The building had a cost on Macks books of $ with $ in accumulated depreciation. It had a sale value of $ with a fiveyear remaining life. This was a cash sale. KappCo has used the land and building in its business operations since its purchase from Mack.

Each year, KappCo sells Mack Corp inventory at a percent gross profit rate. Intercompany sales were $ in and $ in On January percent of the transfers were still on hand, and on December percent of the transfers remained unsold by Mack.

In fiscal year KappCo reported a net income of $ and did not declare a dividend. In Mack Corp. declared dividends of $ and KappCo declared dividends of $ As of December Mack Corp owed KappCo $ for inventory it had purchased in begintabularccccc

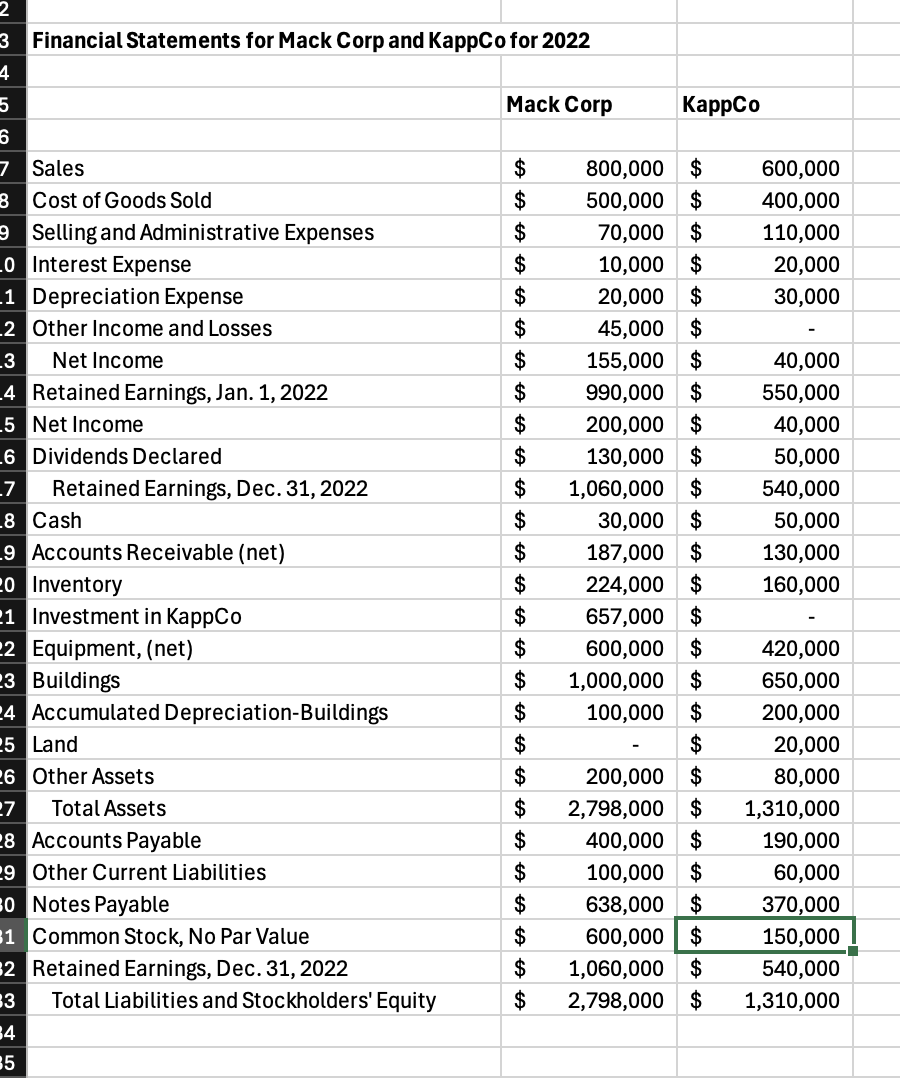

hline multicolumnlFinancial Statements for Mack Corp and KappCo for

hline & multicolumnlMack Corp & multicolumnlKappCo

hline Sales & $ & & $ &

hline Cost of Goods Sold & $ & & $ &

hline Selling and Administrative Expenses & $ & & $ &

hline Interest Expense & $ & & $ &

hline Depreciation Expense & $ & & $ &

hline Other Income and Losses & $ & & $ &

hline Net Income & $ & & $ &

hline Retained Earnings, Jan. & $ & & $ &

hline Net Income & $ & & $ &

hline Dividends Declared & $ & & $ &

hline Retained Earnings, Dec. & $ & & $ &

hline Cash & $ & & $ &

hline Accounts Receivable net & $ & & $ &

hline Inventory & $ & & $ &

hline Investment in KappCo & $ & & $ &

hline Equipment, net & $ & & $ &

hline Buildings & $ & & $ &

hline Accumulated DepreciationBuildings & $ & & $ &

hline Land & $ & & $ &

hline Other Assets & $ & & $ &

hline Total Assets & $ & & $ &

hline Accounts Payable & $ & & $ &

hline Other Current Liabilities & $ & & $ &

hline Notes Payable & $ & & $ &

hline Common Stock, No Par Value & $ & & $ &

hline Retained Earnings, Dec. & $ & & $ &

hline Total Liabilities and Stockholders' Equity & $ & & $ &

hline & & & &

hline & & & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock