Question: The DuPont analysis is a framework for analyzing fundamental performance, it is a useful technique used to decompose the different drivers of return on equity

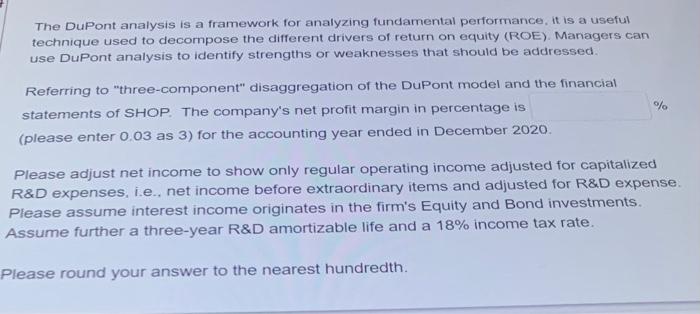

The DuPont analysis is a framework for analyzing fundamental performance, it is a useful technique used to decompose the different drivers of return on equity (ROE), Managers can use DuPont analysis to identify strengths or weaknesses that should be addressed. % Referring to "three-component" disaggregation of the DuPont model and the financial statements of SHOP. The company's net profit margin in percentage is (please enter 0.03 as 3) for the accounting year ended in December 2020. Please adjust net income to show only regular operating income adjusted for capitalized R&D expenses, i.e., net income before extraordinary items and adjusted for R&D expense. Please assume interest income originates in the firm's Equity and Bond investments. Assume further a three-year R&D amortizable life and a 18% income tax rate. Please round your answer to the nearest hundredth. The DuPont analysis is a framework for analyzing fundamental performance, it is a useful technique used to decompose the different drivers of return on equity (ROE), Managers can use DuPont analysis to identify strengths or weaknesses that should be addressed. % Referring to "three-component" disaggregation of the DuPont model and the financial statements of SHOP. The company's net profit margin in percentage is (please enter 0.03 as 3) for the accounting year ended in December 2020. Please adjust net income to show only regular operating income adjusted for capitalized R&D expenses, i.e., net income before extraordinary items and adjusted for R&D expense. Please assume interest income originates in the firm's Equity and Bond investments. Assume further a three-year R&D amortizable life and a 18% income tax rate. Please round your answer to the nearest hundredth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts