Question: The efficient markets hypothesis True or False: The efficient markets hypothesis holds only if all investors are rational. True False Almost all financial theory and

The efficient markets hypothesis

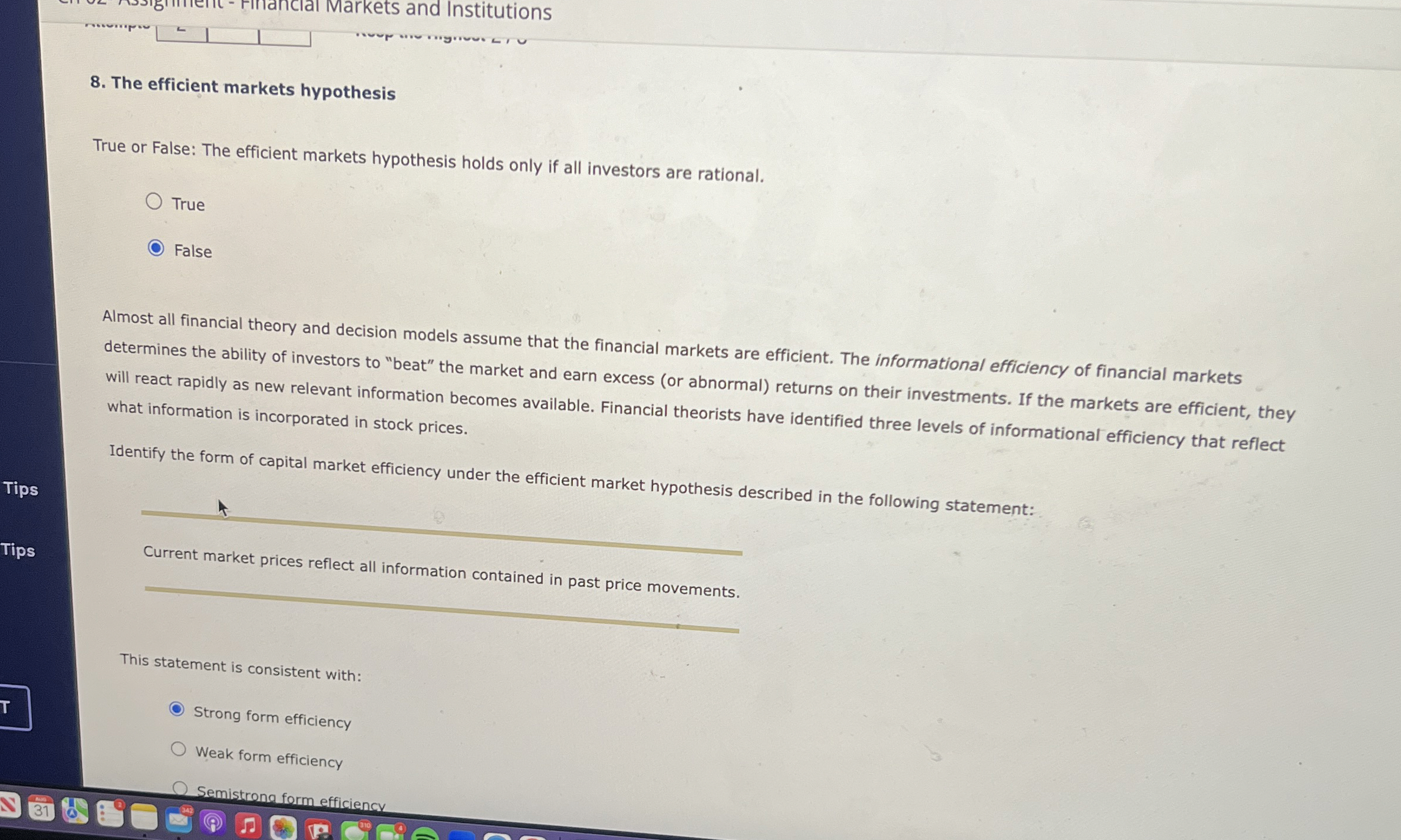

True or False: The efficient markets hypothesis holds only if all investors are rational.

True

False

Almost all financial theory and decision models assume that the financial markets are efficient. The informational efficiency of financial markets determines the ability of investors to "beat" the market and earn excess or abnormal returns on their investments. If the markets are efficient, they will react rapidly as new relevant information becomes available. Financial theorists have identified three levels of informational efficiency that reflect what information is incorporated in stock prices.

Identify the form of capital market efficiency under the efficient market hypothesis described in the following statement:

Tips

This statement is consistent with:

Strong form efficiency

Weak form efficiency

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock