Question: The EFN direct formula has 3 parts. Explain what each part estimates (here, I am looking for the concept behind each part, not the number).

The EFN direct formula has 3 parts. Explain what each part estimates (here, I am looking for the concept behind each part, not the number). ALSO, What are the assumptions implicit in your calculation of Garlands EFN using the direct formula? Kindly be brief.

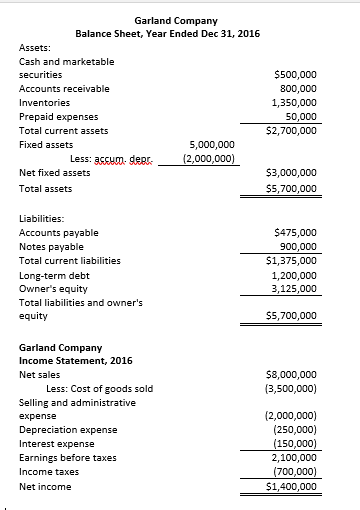

Garland Company Balance Sheet, Year Ended Dec 31, 2016 Assets: Cash and marketable $500,000 800,000 1,350,000 50,000 $2,700,000 Accounts receivable Prepaid expenses Total current assets Fixed assets 5,000,000 3C5uuD geR (2,000,000) $3,000,000 $5,700,000 Net fixed assets Total assets Liabilities: Accounts payable Notes Total current liabilities Long-term debt Owner's equity Total liabilities and owner's equity $475,000 900,000 51,375,000 1,200,000 3,125,000 payable $5,700,000 Garland Company Income Statement, 2016 Net sales $8,000,000 (3,500,000) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income (2,000,000) (250,000) 150,000) 2,100,000 (700,000) 51,400,000 Garland Company Balance Sheet, Year Ended Dec 31, 2016 Assets: Cash and marketable $500,000 800,000 1,350,000 50,000 $2,700,000 Accounts receivable Prepaid expenses Total current assets Fixed assets 5,000,000 3C5uuD geR (2,000,000) $3,000,000 $5,700,000 Net fixed assets Total assets Liabilities: Accounts payable Notes Total current liabilities Long-term debt Owner's equity Total liabilities and owner's equity $475,000 900,000 51,375,000 1,200,000 3,125,000 payable $5,700,000 Garland Company Income Statement, 2016 Net sales $8,000,000 (3,500,000) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income (2,000,000) (250,000) 150,000) 2,100,000 (700,000) 51,400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts