Question: The enterprise value equation that is used for comparable valuation analysis is different from the standard equation for enterprise value. Specifically, the enterprise value equation

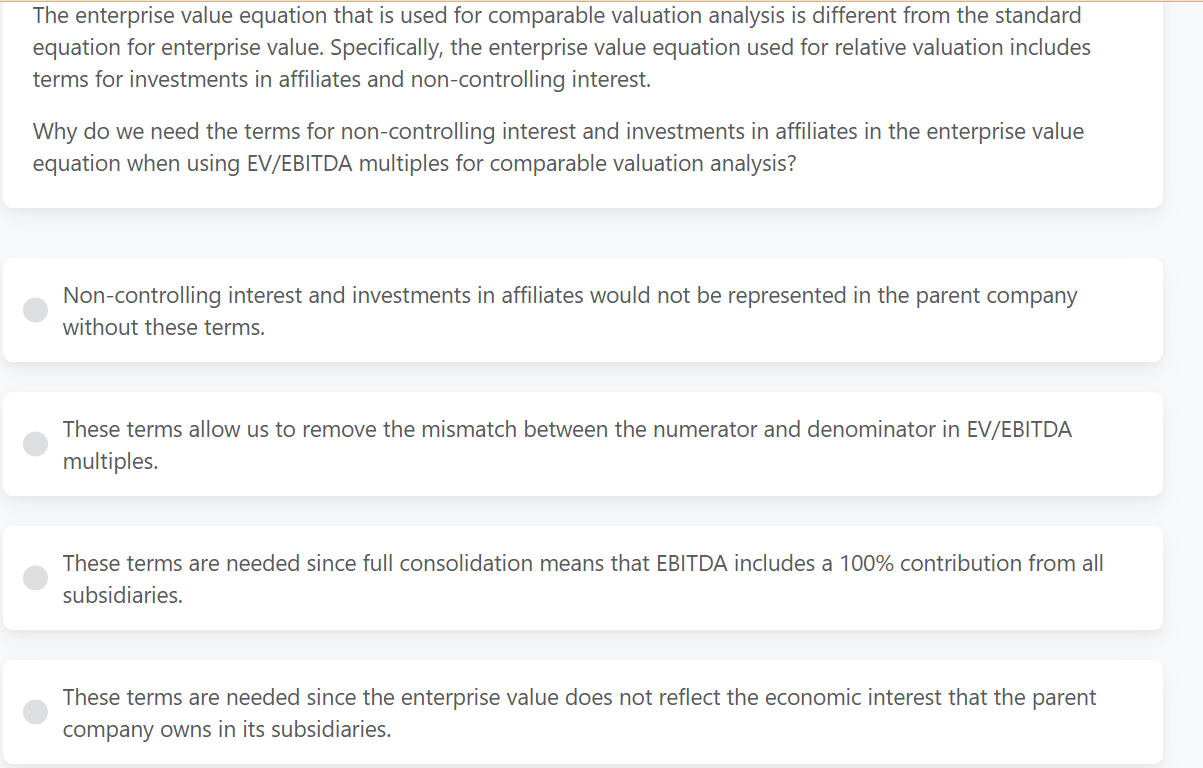

The enterprise value equation that is used for comparable valuation analysis is different from the standard equation for enterprise value. Specifically, the enterprise value equation used for relative valuation includes terms for investments in affiliates and noncontrolling interest.

Why do we need the terms for noncontrolling interest and investments in affiliates in the enterprise value equation when using EVEBITDA multiples for comparable valuation analysis?

Noncontrolling interest and investments in affiliates would not be represented in the parent company without these terms.

These terms allow us to remove the mismatch between the numerator and denominator in EVEBITDA multiples.

These terms are needed since full consolidation means that EBITDA includes a contribution from all subsidiaries.

These terms are needed since the enterprise value does not reflect the economic interest that the parent company owns in its subsidiaries.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock