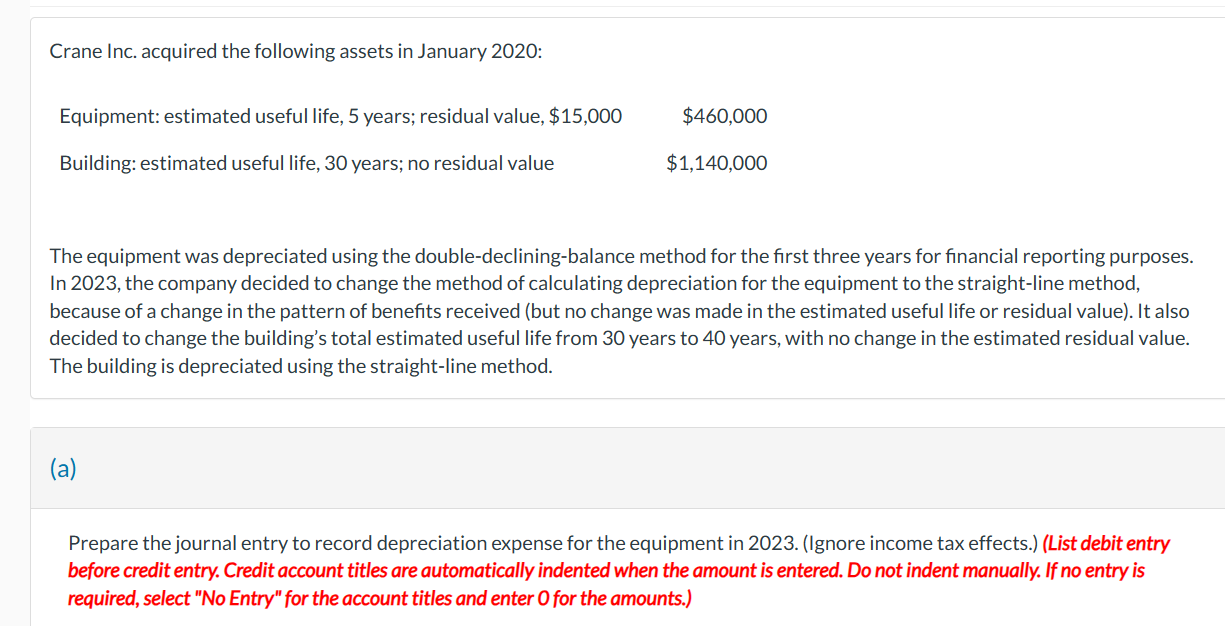

Question: The equipment was depreciated using the double-declining-balance method for the first three years for financial reporting purposes. In 2023, the company decided to change the

The equipment was depreciated using the double-declining-balance method for the first three years for financial reporting purposes. In 2023, the company decided to change the method of calculating depreciation for the equipment to the straight-line method, because of a change in the pattern of benefits received (but no change was made in the estimated useful life or residual value). It also decided to change the building's total estimated useful life from 30 years to 40 years, with no change in the estimated residual value. The building is depreciated using the straight-line method. (a) Prepare the journal entry to record depreciation expense for the equipment in 2023. (Ignore income tax effects.) (List debit entry before credit entry. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts