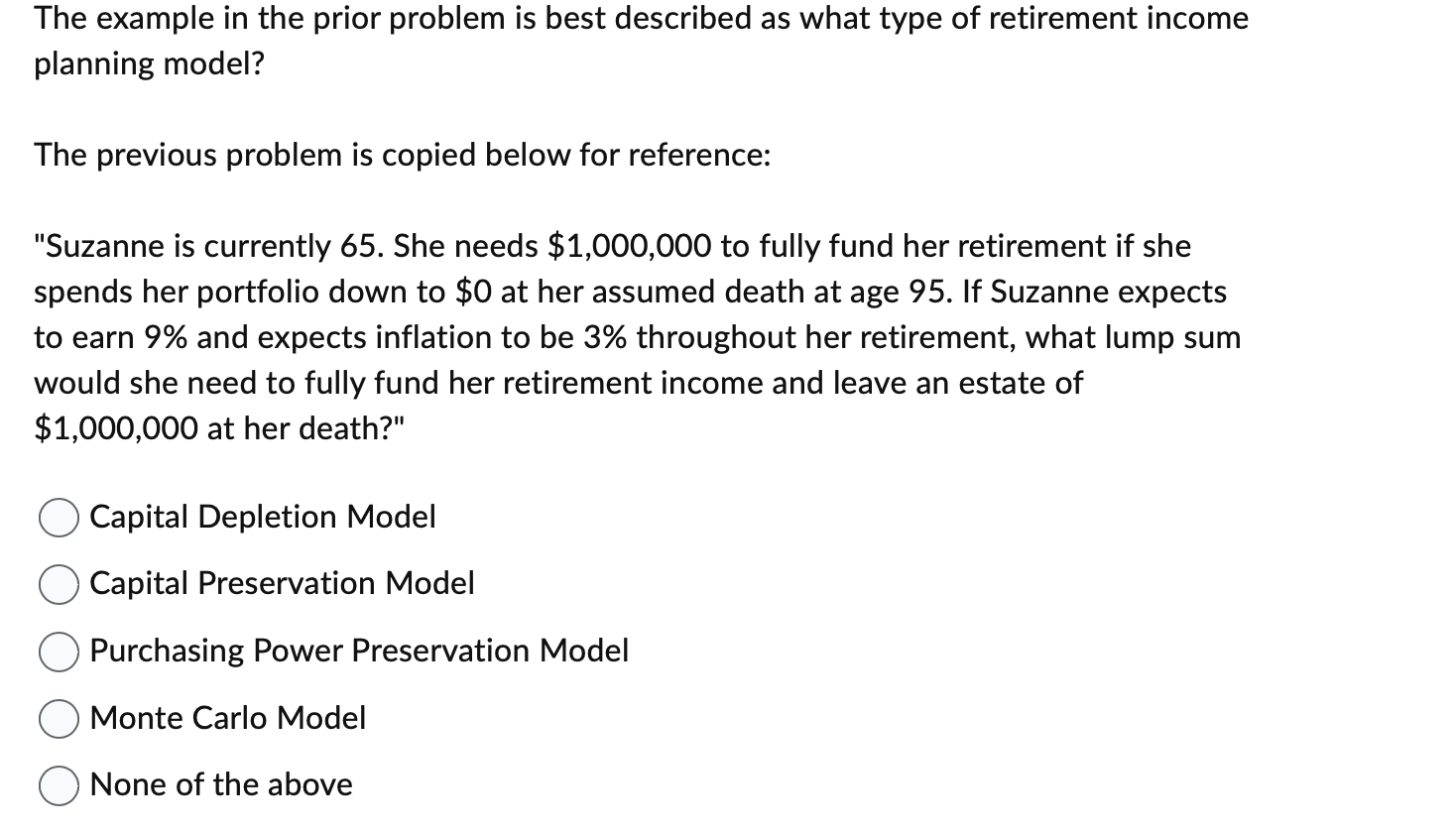

Question: The example in the prior problem is best described as what type of retirement income planning model? The previous problem is copied below for reference:

The example in the prior problem is best described as what type of retirement income planning model? The previous problem is copied below for reference: "Suzanne is currently 65. She needs $1,000,000 to fully fund her retirement if she spends her portfolio down to $0 at her assumed death at age 95 . If Suzanne expects to earn 9% and expects inflation to be 3% throughout her retirement, what lump sum would she need to fully fund her retirement income and leave an estate of $1,000,000 at her death?" Capital Depletion Model Capital Preservation Model Purchasing Power Preservation Model Monte Carlo Model None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts