Question: The example is how the answers should be formatted as. Venus Company uses a perpetual inventory system. Following are the 2019 purchases and sales: Beginning

The example is how the answers should be formatted as.

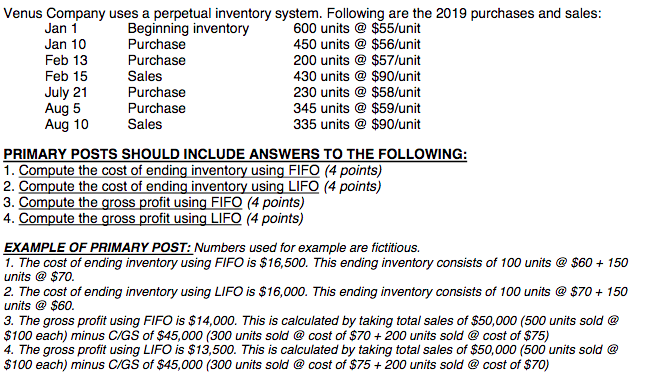

Venus Company uses a perpetual inventory system. Following are the 2019 purchases and sales: Beginning inventory 600 units @$55/unit 450 units @ $56/unit 200 units @ $57/unit 430 units @ $90/unit 230 units @ $58/unit 345 units @ $59/unit 335 units @ $90/unit Jan 1 Jan 10 Purchase Feb 13 Purchase Feb 15 Sales July 21 Aug 5 Aug 10 Purchase Purchase Sales PRIMARY POSTS SHOULD INCLUDE ANSWERS TO THE FOLLOWING: 1. Compute the cost of ending inventory using FIFO (4 points) 2. Compute the cost of ending inventory using LIFO (4 points) 3. Compute the gross profit using FIFO (4 points) 4. Compute the gross profit using LIFO (4 points) EXAMPLE OF PRIMARY POST: Numbers used for example are fictitious. 1. The cost of ending inventory using FIFO is $16,500. This ending inventory consists of 100 units $60 150 units $70. 2. The cost of ending inventory using LIFO is $16,000. This ending inventory consists of 100 units$70 150 units $60 3. The gross profit using FIFO is $14,000. This is calculated by taking total sales of $50,000 (500 units sold @ $100 each) minus C/GS of $45,000 (300 units sold @cost of $70200 units sold @ cost of $75) 4. The gross profit using LIFO is $13,500. This is calculated by taking total sales of $50,000 (500 units sold @ $100 each) minus C/GS of $45,000 (300 units sold @cost of $75 +200 units sold @cost of $70)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts