Question: The Excel Application box in the chapter shows how to use the spot-futures parlty relationship to find a term structure of futures prices, that

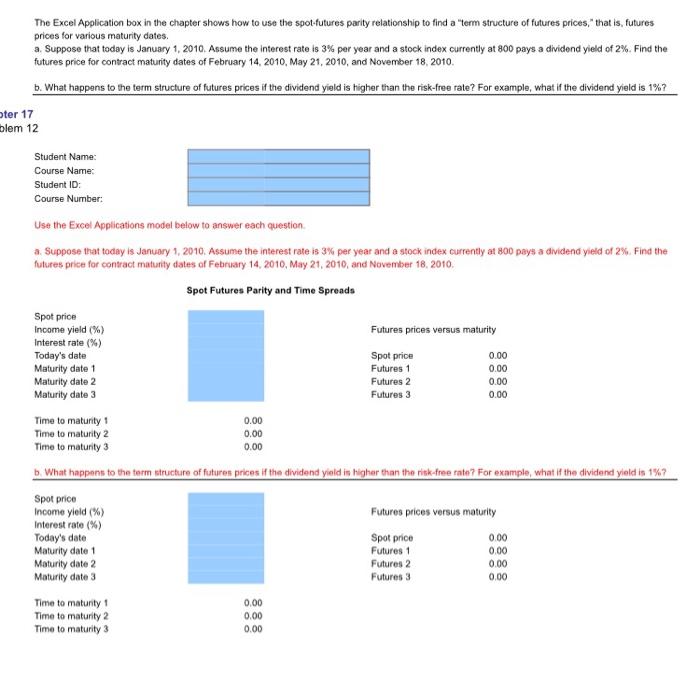

The Excel Application box in the chapter shows how to use the spot-futures parlty relationship to find a "term structure of futures prices, " that is, futures prices for various maturity dates. a Suppose that today is January 1, 2010. Assume the interest rate is 3% per year and a stock index currently at 800 pays a dividend yield of 2%. Find the futures price for contract maturity dates of February 14, 2010, May 21, 2010, and November 18, 2010 b. What happens to the term structure of futures prices if the dividend yield is higher than the risk-free rate? For example, what if the dividend yield is 1%7 ter 17 blem 12 Student Name: Course Name: Student ID: Course Number: Use the Excel Applications model below to answer each question a Suppose that today is January 1, 2010. Assume the interest rate is 3% per year and a stock index currently at 800 pays a dividend yield of 2%. Find the futures price for contract maturity dates of February 14, 2010, May 21, 2010, and November 18, 2010 Spot Futures Parity and Time Spreads Futures prices versus maturity Spot price Income yield (%) Interest rate (%) Today's date Maturity date 1 Maturity date 2 Maturity date 3 Spot price Futures 1 Futures 2 Futures 3 0.00 0.00 0.00 0.00 Time to maturity 1 Time to maturity 2 Time to maturity 3 b. What happens to the term structure of futures prices if the dividend yield in higher than the risk-free rate? For example, what if the dividend yield is 1%? 0.00 0.00 0.00 Spot price Income yield (%) Interest rate (%) Today's date Maturity date 1 Maturity date 2 Maturity date 3 Futures prices versus maturity Spot price Futures 1 0.00 Futures 2 0.00 Futures 3 0.00 0.00 Time to matunty 1 Time to maturity 2 Time to maturity 3 0.00 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts