Question: The Excel Spreadsheet Project is a computer project designed to help you develop spreadsheet skills. You will prepare consolidated worksheets using formulas that illustrate the

The Excel Spreadsheet Project is a computer project designed to help you develop spreadsheet skills. You will prepare consolidated worksheets using formulas that illustrate the consolidation entries needed when the parent uses the equity method, partial equity method, or initial value method of accounting for its investment in a subsidiary. The detailed information for this project is found at the end of Chapter 3 under the heading of Excel Spreadsheet Project. INSTRUCTIONS You are to create an Excel workbook with 4 tabs as follows: Tab 1 Consolidated Information Worksheet Tab 2 Equity Method Tab 3 Partial Equity Method Tab 4 Initial Value Method This assignment encompasses the first 3 project requirements as listed in the Computer Project within the textbook. The consolidated worksheets that you are preparing are not for the year of acquisition, but for the succeeding year. Therefore, when determining the beginning parent company retained earnings and Investment account balances for the year in question under the initial value and partial equity methods, remember that those balances will be converted to the equity method as of the beginning of the year in the consolidated worksheet via the *C entry. The beginning retained earnings and investment account balances based on parent company records will differ under each of the three methods. The difference will be reflected in the *C entry.

For Excel Spreadsheet Project: Final Assignment, you must complete all remaining information for Tabs 24. This assignment encompasses the third project requirement stated in the textbook.

Textbook Info:

3. Using reference to other cells only (Either from the consolidated information worksheet or from the separate method sheets). prepare for each of the three consolidated worksheets:

- Adjustsments and eliminations

- Consolidated balances

Please help with the fair-value allocation, adjustments, eliminations, and consolidated balances

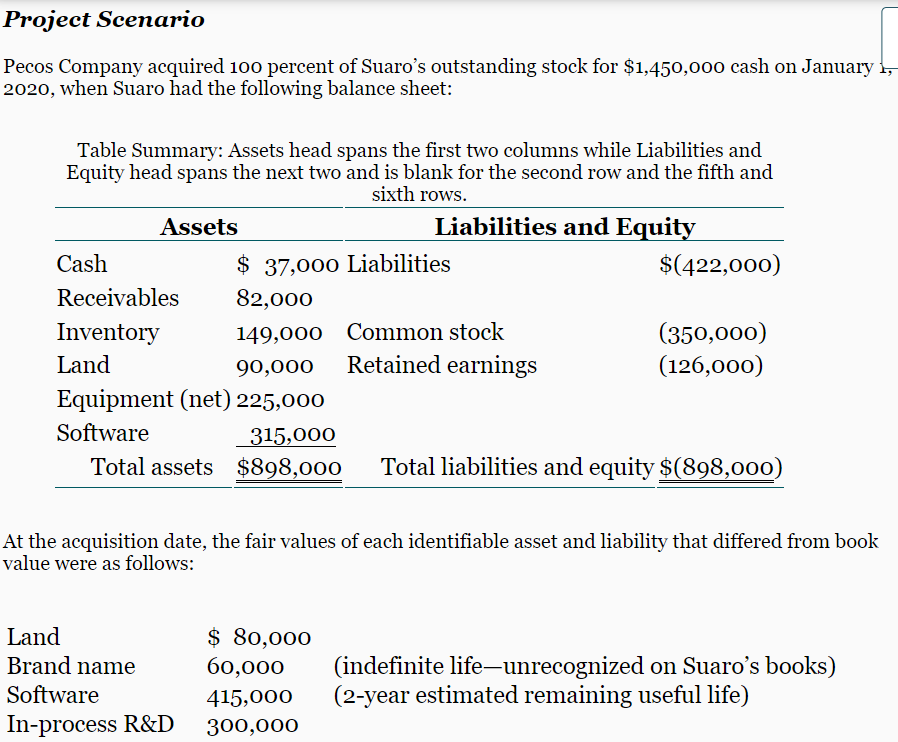

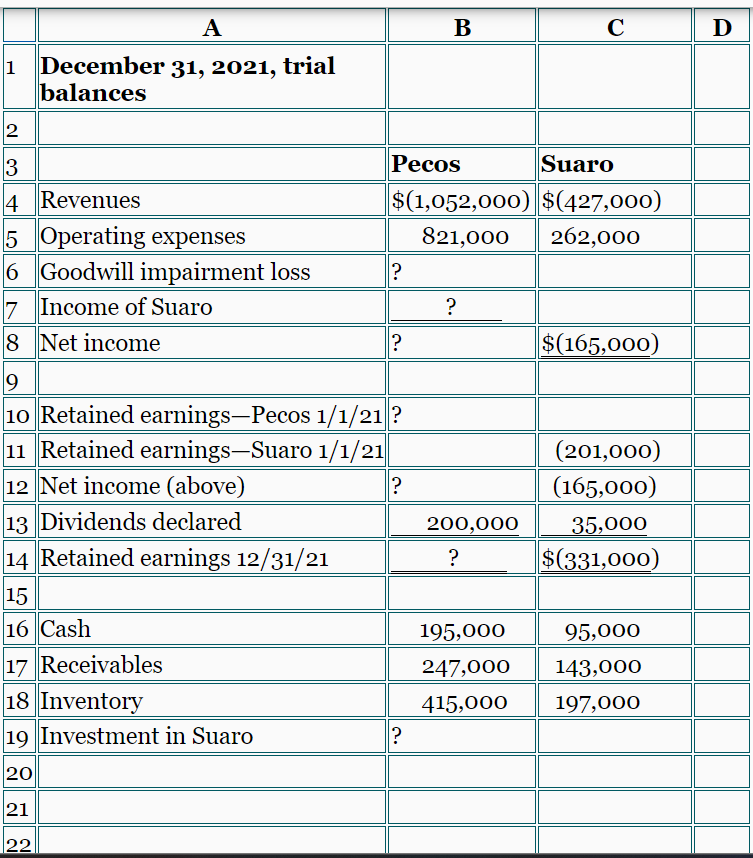

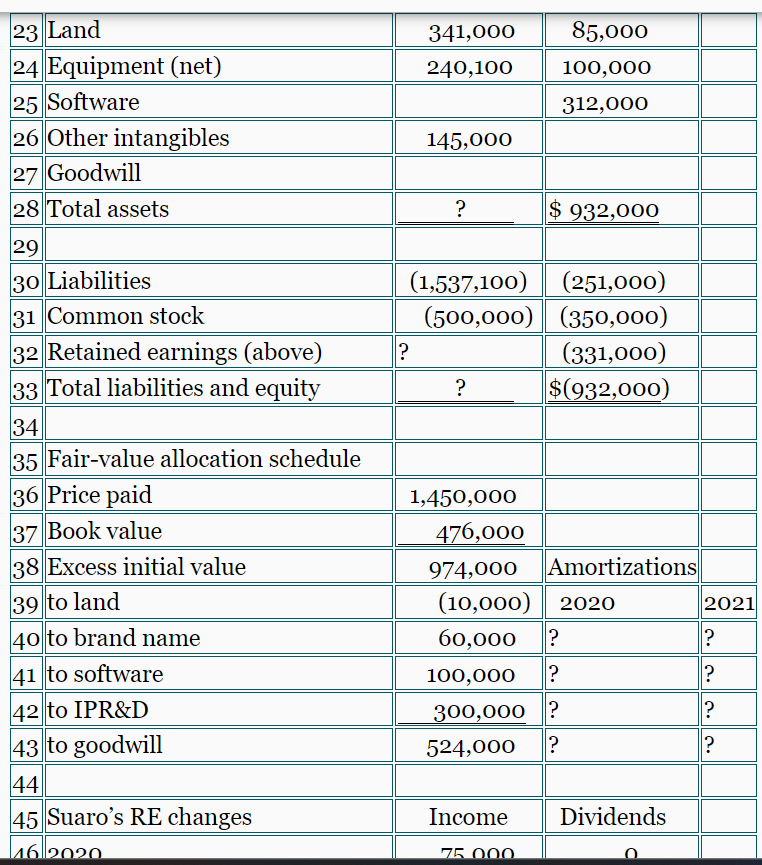

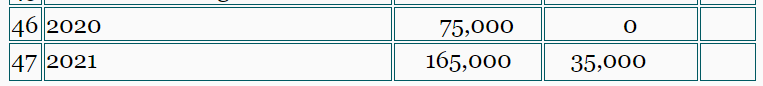

Project Scenario Pecos Company acquired 100 percent of Suaro's outstanding stock for $1,450, ooo cash on January 1 , 2020, when Suaro had the following balance sheet: Table Summary: Assets head spans the first two columns while Liabilities and Equity head spans the next two and is blank for the second row and the fifth and civth rovite At the acquisition date, the fair values of each identifiable asset and liability that differed from book alue were as follows: \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & D \\ \hline 1 & December31,2021,trialbalances & & & \\ \hline \\ \hline 3 & & Pecos & Suaro & \\ \hline 4 & Revenues & $(1,052,000) & $(427,000) & \\ \hline 5 & Operating expenses & 821,000 & 262,000 & \\ \hline 6 & Goodwill impairment loss & ? & & \\ \hline 7 & Income of Suaro & ? & & \\ \hline 8 & Net income & ? & $(165,000) & \\ \hline \multicolumn{4}{|l|}{9} & \\ \hline 10 & Retained earnings-Pecos 1/1/21 & ? & & \\ \hline 11 & Retained earnings-Suaro 1/1/21 & & (201,000) & \\ \hline 12 & Net income (above) & ? & (165,000) & \\ \hline 13 & Dividends declared & 200,000 & 35,000 & \\ \hline 14 & Retained earnings 12/31/21 & ? & $(331,000) & \\ \hline \multicolumn{4}{|l|}{15} & \\ \hline 16 & Cash & 195,000 & 95,000 & \\ \hline 17 & Receivables & 247,000 & 143,000 & \\ \hline 18 & Inventory & 415,000 & 197,000 & \\ \hline 19 & Investment in Suaro & ? & & \\ \hline 20 & & & & \\ \hline 21 & & & & \\ \hline 22 & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \begin{tabular}{|l|} 23 \\ \end{tabular} & Land & 341,000 & 85,000 & \\ \hline 24 I & Equipment (net) & 240,100 & 100,000 & \\ \hline 25 & Software & & 312,000 & \\ \hline 26 ( & Other intangibles & 145,000 & & \\ \hline 27 ( & Goodwill & & & \\ \hline \begin{tabular}{|l|l|l} 28 & 2 \\ \end{tabular} & Total assets & ? & $932,000 & \\ \hline 29 & & & & \\ \hline 301 & Liabilities & (1,537,100) & (251,000) & \\ \hline \begin{tabular}{|c|c} 31 & 6 \\ \end{tabular} & Common stock & (500,000) & (350,000) & \\ \hline \begin{tabular}{|l|ll} 32 & 1 \\ \end{tabular} & Retained earnings (above) & ? & (331,000) & \\ \hline 33 & Total liabilities and equity & ? & $(932,000) & \\ \hline 34 & & & & \\ \hline \begin{tabular}{|lll} & 1 \\ 35 & 1 \end{tabular} & Fair-value allocation schedule & & & \\ \hline \begin{tabular}{|lll} 36 & 1 \\ \end{tabular} & Price paid & 1,450,000 & & \\ \hline 37 1 & Book value & 476,000 & & \\ \hline \begin{tabular}{|l|l} 38 & 1 \\ \end{tabular} & Excess initial value & 974,000 & Amortizations & \\ \hline 39t & to land & (10,000) & 2020 & 2021 \\ \hline 40t & to brand name & 60,000 & ? & ? \\ \hline \begin{tabular}{|l|ll} 41 & t \\ \end{tabular} & to software & 100,000 & ? & ? \\ \hline 42t & to IPR\&D & 300,000 & ? & ? \\ \hline 43t & to goodwill & 524,000 & ? & ? \\ \hline 44 & & & & \\ \hline 45 & Suaro's RE changes & Income & Dividends & \\ \hline \end{tabular} \begin{tabular}{|l|l||r||c||c|} \hline 46 & 2020 & 75,000 & 0 & \\ \hline \hline 47 & 2021 & 165,000 & 35,000 & \\ \hline \end{tabular} Project Scenario Pecos Company acquired 100 percent of Suaro's outstanding stock for $1,450, ooo cash on January 1 , 2020, when Suaro had the following balance sheet: Table Summary: Assets head spans the first two columns while Liabilities and Equity head spans the next two and is blank for the second row and the fifth and civth rovite At the acquisition date, the fair values of each identifiable asset and liability that differed from book alue were as follows: \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & D \\ \hline 1 & December31,2021,trialbalances & & & \\ \hline \\ \hline 3 & & Pecos & Suaro & \\ \hline 4 & Revenues & $(1,052,000) & $(427,000) & \\ \hline 5 & Operating expenses & 821,000 & 262,000 & \\ \hline 6 & Goodwill impairment loss & ? & & \\ \hline 7 & Income of Suaro & ? & & \\ \hline 8 & Net income & ? & $(165,000) & \\ \hline \multicolumn{4}{|l|}{9} & \\ \hline 10 & Retained earnings-Pecos 1/1/21 & ? & & \\ \hline 11 & Retained earnings-Suaro 1/1/21 & & (201,000) & \\ \hline 12 & Net income (above) & ? & (165,000) & \\ \hline 13 & Dividends declared & 200,000 & 35,000 & \\ \hline 14 & Retained earnings 12/31/21 & ? & $(331,000) & \\ \hline \multicolumn{4}{|l|}{15} & \\ \hline 16 & Cash & 195,000 & 95,000 & \\ \hline 17 & Receivables & 247,000 & 143,000 & \\ \hline 18 & Inventory & 415,000 & 197,000 & \\ \hline 19 & Investment in Suaro & ? & & \\ \hline 20 & & & & \\ \hline 21 & & & & \\ \hline 22 & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \begin{tabular}{|l|} 23 \\ \end{tabular} & Land & 341,000 & 85,000 & \\ \hline 24 I & Equipment (net) & 240,100 & 100,000 & \\ \hline 25 & Software & & 312,000 & \\ \hline 26 ( & Other intangibles & 145,000 & & \\ \hline 27 ( & Goodwill & & & \\ \hline \begin{tabular}{|l|l|l} 28 & 2 \\ \end{tabular} & Total assets & ? & $932,000 & \\ \hline 29 & & & & \\ \hline 301 & Liabilities & (1,537,100) & (251,000) & \\ \hline \begin{tabular}{|c|c} 31 & 6 \\ \end{tabular} & Common stock & (500,000) & (350,000) & \\ \hline \begin{tabular}{|l|ll} 32 & 1 \\ \end{tabular} & Retained earnings (above) & ? & (331,000) & \\ \hline 33 & Total liabilities and equity & ? & $(932,000) & \\ \hline 34 & & & & \\ \hline \begin{tabular}{|lll} & 1 \\ 35 & 1 \end{tabular} & Fair-value allocation schedule & & & \\ \hline \begin{tabular}{|lll} 36 & 1 \\ \end{tabular} & Price paid & 1,450,000 & & \\ \hline 37 1 & Book value & 476,000 & & \\ \hline \begin{tabular}{|l|l} 38 & 1 \\ \end{tabular} & Excess initial value & 974,000 & Amortizations & \\ \hline 39t & to land & (10,000) & 2020 & 2021 \\ \hline 40t & to brand name & 60,000 & ? & ? \\ \hline \begin{tabular}{|l|ll} 41 & t \\ \end{tabular} & to software & 100,000 & ? & ? \\ \hline 42t & to IPR\&D & 300,000 & ? & ? \\ \hline 43t & to goodwill & 524,000 & ? & ? \\ \hline 44 & & & & \\ \hline 45 & Suaro's RE changes & Income & Dividends & \\ \hline \end{tabular} \begin{tabular}{|l|l||r||c||c|} \hline 46 & 2020 & 75,000 & 0 & \\ \hline \hline 47 & 2021 & 165,000 & 35,000 & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts