Question: The Excel workbook titled Return xlsx (available on the class web page contains monthly returns on 4 stocks (ISLA Tesla, NFLX. Netflix, JNJ: Johnson &

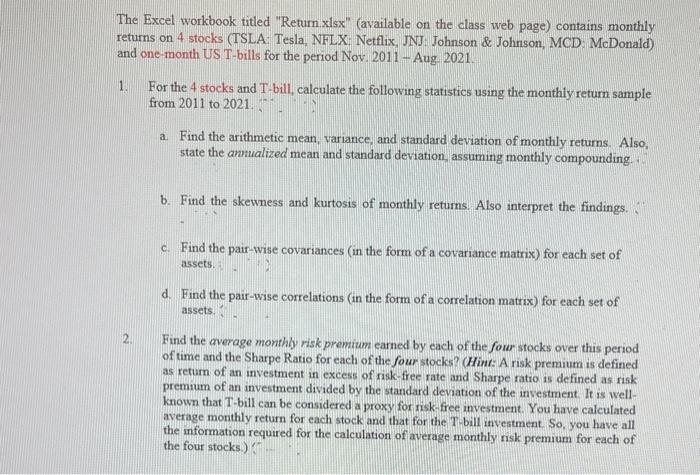

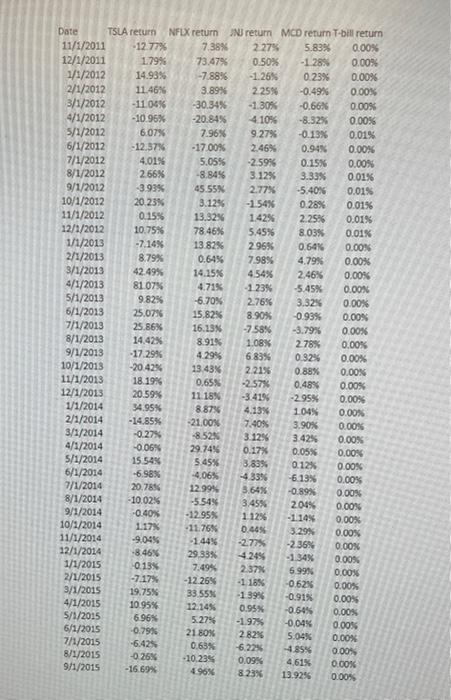

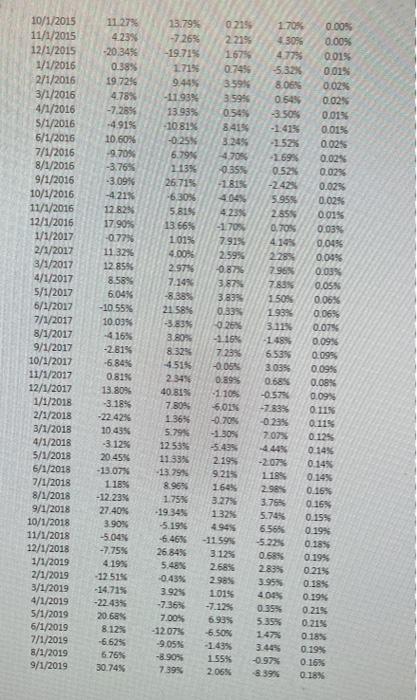

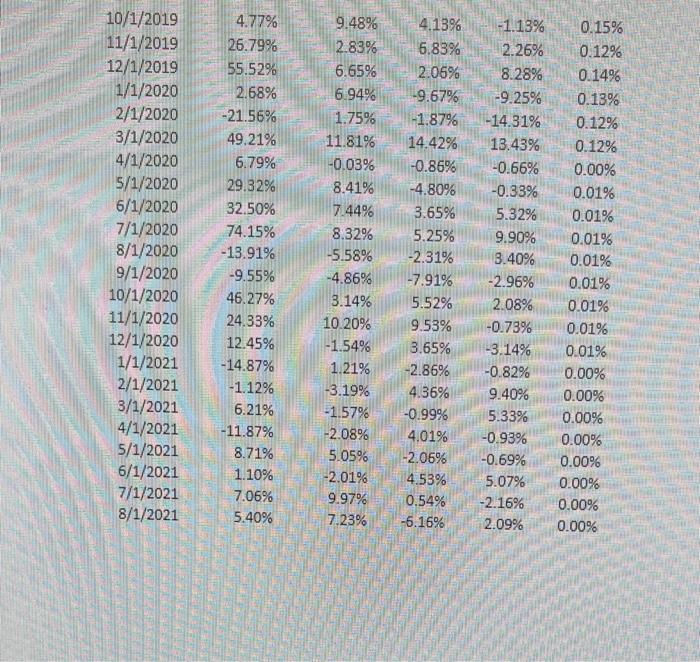

The Excel workbook titled "Return xlsx" (available on the class web page contains monthly returns on 4 stocks (ISLA Tesla, NFLX. Netflix, JNJ: Johnson & Johnson, MCD McDonald) and one-month US T-bills for the period Nov. 2011 - Aug 2021 1. For the 4 stocks and T-bill, calculate the following statistics using the monthly return sample from 2011 to 2021 a Find the arithmetic mean, variance, and standard deviation of monthly returns. Also, state the annualized mean and standard deviation, assuming monthly compounding b. Find the skewness and kurtosis of monthly returns. Also interpret the findings c. Find the pair-wise covariances (in the form of a covariance matrix) for each set of assets. d. Find the pair-wise correlations in the form of a correlation matrix) for each set of assets. 2. Find the average monthly risk premium earned by each of the four stocks over this period of time and the Sharpe Ratio for each of the four stocks? (Hint: A risk premium is defined as retum of an investment in excess of risk-free rate and Sharpe ratio is defined as risk premium of an investment divided by the standard deviation of the investment. It is well- known that T-bill can be considered a proxy for risk-free investment. You have calculated average monthly return for each stock and that for the T bill investment. So, you have all the information required for the calculation of average monthly risk premium for each of the four stocks.) Date TSLA return NFLX return NJ return MCD return T-bill return 11/1/2011 -12.77% 7.38% 2.27% 5.83% 0.00% 12/1/2011 1.79% 73.47% 0.50% -1 28 0.00% 1/1/2012 14.93% -7.88% -1.26% 0.23% 0.00% 2/1/2012 11.46% 3.89% 2.25% -0.49% 0.00% 3/1/2012 -11.04% -30.34% -1.30% -0.66% 0.00% 4/1/2012 -10.95% -20.84% 4.10% -8.32% 0.00% 5/1/2012 6.07% 7.96% 9.27% -0.13% 0.01% 6/1/2012 -12.37% -17.00% 2.46% 0.94% 0.00% 7/1/2012 4.01% 5.05% -2.59% 0.15% 0.00% 8/1/2012 2.66% -8.84% 3 12% 3.33% 0.01% 9/1/2012 -3.93% 45.55% 2.77% -5.40% 0.01% 10/1/2012 20.23% 3.12% -1.54% 0.28% 0.01% 11/1/2012 0.15% 13.82% 1.42% 2.25% 0.01% 12/1/2012 10.75% 78.46% 5.45% 8.03% 0.01% 1/1/2013 -7.14% 13.82% 2.95% 0.64% 0.00% 2/1/2013 8.79% 0.64% 7.98% 4.79% 0.00% 3/1/2013 42.49% 14.15% 454% 2.46% 0.00% 4/1/2013 81.07% 4.71% 1.23% -5.45% 0.00N 5/1/2013 9.82% -6.70% 2.76% 3.32% 0.00% 6/1/2013 25.07% 15.82% 8.90% -0.93% 0.00% 7/1/2013 25.86% 16.13% -758% -3.79% 0.00% 8/1/2013 14.42% 8.91% 1.08% 2.75% 0.00% 9/1/2013 -17.29% 4.29% 6 89% 0.32% 0.00% 10/1/2018 -20.42% 13.43% 2.2156 0.88% 0.00% 11/1/2013 18. 19% 0,65% -2.57% 0.48% 0.00% 12/1/2013 20.59% 11 15% -3.4196 -2.95% 0.00% 1/1/2014 34.95 8.87% 4.13% 1045 0.00% 2/1/2014 -14.85% -21.00% 7.40% 3.90% 0.00% 3/1/2014 -0.27% -8.52 3.12% 3.42% 0.00% 4/1/2014 -0.06% 29.74% 0.17% 0.05% 0.00% 5/1/2014 15.54 5.45% 3.83% 0.12% 0.00% 6/1/2014 -6.98% -4,06% -4.33% -6.13% 0.00% 7/1/2014 20.785 12.99% 3.64% -0.89% 0.00% 8/1/2014 -10.02% -5.54% 3.45% 204% 0.00% 9/1/2014 -0.40% - 12.95% 1 12% -1 14% 0.00% 10/1/2014 1.17% -11.76% 0.445 3.29% 11/1/2014 -9.045 1.44% -2364 0.00% 12/1/2014 -8.46% 29.33% 4245 -1.34% 0.00% 1/1/2015 0 13% 7.49% 2.37% 6.99% 0.00% 2/1/2015 -7.17% -12 26% -1 16% -0.62% 0.00% 3/1/2015 19.75% 33.55% -1.39% -0.91% 0.00% 4/1/2015 10.95% 12.145 0.95% -0.54% 0.00% 5/1/2015 6.96% 5.27% -1.97% -0.04% 0.00% 6/1/2015 -0.79% 21 80% 2.82% 5.04% 0.00% 7/1/2015 -6.42% 0.63% -6.22% -4.85% 0.00 8/1/2015 -0.26% - 10.23% 0.09% 4,61% 0.00% 9/1/2015 - 16 69% 496% 8.23% 13.9255 0.00% 0.00% 10/1/2015 11/1/2015 12/1/2015 1/1/2016 2/1/2016 3/1/2016 4/1/2016 S/1/2016 6/1/2016 7/1/2016 8/1/2016 9/1/2016 10/1/2016 11/1/2016 12/1/2016 1/1/2017 2/1/2017 3/1/2017 4/1/2017 5/1/2017 6/1/2017 7/1/2017 8/1/2017 9/1/2017 10/1/2017 11/1/2017 12/1/2017 1/1/2018 2/1/2018 3/1/2018 4/1/2018 5/1/2018 6/1/2018 7/1/2018 8/1/2018 9/1/2018 10/1/2018 11/1/2018 12/1/2018 1/1/2019 2/1/2019 3/1/2019 4/1/2019 5/1/2019 6/1/2019 7/1/2019 8/1/2019 9/1/2019 11 27% 4.23% -20.345 0.38% 19.7296 4.78% -7.28% -4.91% 10.60% -9.70% -3.76% -3.09% -4 21% 12 82 17.90% -0.77% 11 329 12 85% 8.58% 6.04% -10.55% 10.03% -4.15% -2815 -6.84% 0.81% 13.80 -3.18% -22.42% 10.455 3.1254 20.45% -13.07% 1 18% -12-2396 27.40% 3.90% -5.04% -7,75% 4. 19 12515 -14.71% -22.43% 20.68% 8 125 -6.62% 6.76% 30.74% 13.79% -7.26% -19.71% 1715 9.445 -1.93% 13.93% -10.81% -0.25% 6.79% 1.13% 26.719 -6.3056 5.815 13.66% 101% 400% 2.97% 7.14% -8.385 21 58% -3.8395 3.80 8.325 -4.515 2.34% 40.815 7.80% 1.36% 5.79% 12 595 11 33% -13.79% 8.96% 1.75% -19 34% -5.1996 -6.46% 26,84% 5.48% -0.43% 3.925 -7.36% 7.00% - 12.07% -9.05% -8.90% 7.39% 0215 2219 1.67% 0.745 3.59% 3.594 0.54% 84154 3.245 -4.705 -0.355 -181% 404% 4.23% -170 7915 2.59% -0.8736 3.87% 3.839 0.33% 0.26% -116 7 235 -0.06% 0.89 1.105 -60156 -0.70% -1.305 -5.439 2.1995 9.215 1.64% 3.27% 1325 4.945 - 11.59% 3 125 2.68% 2.985 1015 -7.125 6.935 -6.50% -1.43% 1.55% 2065 1.70% 43056 4779 -5.32% 8.06 0.545 -3.50 -1.413 -1525 1699 0.52% -2423 5.95% 2855 0.705 4 145 2208 7.96 7838 1505 1939 3.11% -1489 5.53% 30396 0.685 -0.57% -7.83% -0.295 7.07% 0.005 0.00% 0.01% 0.01% 0.02% 0.02% 0.01 0.01% 0.02% 0.02% 0.02% 0.02% 0.02% 0.01% 0.03% 0,04% 0.09% 0.03% 0.05% 0.06% 0.06% 0.07% 0.09% 0:09 0.09% 0.08% 0.09% 0.11% 0.11% 0.125 0.14% 0.14% 0.14% 0.16% 0.16% 0.15% 0.19% 0.18% 0.19% 0.2136 0.18% 0.19% 0.215 0.21% 0.18% 0 19% 0.16% 0.18% -20790 1199 2.96% 3.759 5.74% 6.56% -5.225 0.58% 28395 3.95% 400 0.35% 53556 1473 3.44 -0.97% 83986 10/1/2019 11/1/2019 12/1/2019 1/1/2020 2/1/2020 3/1/2020 4/1/2020 5/1/2020 6/1/2020 7/1/2020 8/1/2020 9/1/2020 10/1/2020 11/1/2020 12/1/2020 1/1/2021 2/1/2021 3/1/2021 4/1/2021 5/1/2021 6/1/2021 7/1/2021 8/1/2021 4.77% 26.79% 55.52% 2.68% -21.56% 49.21% 6.79% 29.32% 32.50% 74.15% -13.91% -9.55% 46.27% 24.33% 12.45% -14.87% -1.12% 6.21% -11.87% 8.71% 1.10% 7.06% 5.40% 9.48% 2.83% 6.65% 6.94% 1.75% 11.81% -0.03% 8.41% 7.44% 8.32% -5.58% -4.86% 3.14% 10.20% -1.54% 1.21% -3.19% -1.57% -2.08% 5.05% -2.01% 9.97% 7.23% 4.13% 5.83% 2.06% -9.67% -1.87% 14.42% -0.86% -4.80% 3.65% 5.25% -2.31% -7.91% 5.52% 9.53% 3.65% -2.86% 4.36% -0.99% 4.01% -2.06% 4.53% 0.54% -6.16% -1.13% 2.26% 8.28% -9.25% -14.31% 13.43% -0.66% -0.33% 5.32% 9.90% 3.40% -2.96% 2.08% -0.79% -3.14% -0.82% 9.40% 5.33% -0.93% -0.69% 5.07% -2.16% 2.09% 0.15% 0.12% 0.14% 0.13% 0.12% 0.12% 0.00% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% The Excel workbook titled "Return xlsx" (available on the class web page contains monthly returns on 4 stocks (ISLA Tesla, NFLX. Netflix, JNJ: Johnson & Johnson, MCD McDonald) and one-month US T-bills for the period Nov. 2011 - Aug 2021 1. For the 4 stocks and T-bill, calculate the following statistics using the monthly return sample from 2011 to 2021 a Find the arithmetic mean, variance, and standard deviation of monthly returns. Also, state the annualized mean and standard deviation, assuming monthly compounding b. Find the skewness and kurtosis of monthly returns. Also interpret the findings c. Find the pair-wise covariances (in the form of a covariance matrix) for each set of assets. d. Find the pair-wise correlations in the form of a correlation matrix) for each set of assets. 2. Find the average monthly risk premium earned by each of the four stocks over this period of time and the Sharpe Ratio for each of the four stocks? (Hint: A risk premium is defined as retum of an investment in excess of risk-free rate and Sharpe ratio is defined as risk premium of an investment divided by the standard deviation of the investment. It is well- known that T-bill can be considered a proxy for risk-free investment. You have calculated average monthly return for each stock and that for the T bill investment. So, you have all the information required for the calculation of average monthly risk premium for each of the four stocks.) Date TSLA return NFLX return NJ return MCD return T-bill return 11/1/2011 -12.77% 7.38% 2.27% 5.83% 0.00% 12/1/2011 1.79% 73.47% 0.50% -1 28 0.00% 1/1/2012 14.93% -7.88% -1.26% 0.23% 0.00% 2/1/2012 11.46% 3.89% 2.25% -0.49% 0.00% 3/1/2012 -11.04% -30.34% -1.30% -0.66% 0.00% 4/1/2012 -10.95% -20.84% 4.10% -8.32% 0.00% 5/1/2012 6.07% 7.96% 9.27% -0.13% 0.01% 6/1/2012 -12.37% -17.00% 2.46% 0.94% 0.00% 7/1/2012 4.01% 5.05% -2.59% 0.15% 0.00% 8/1/2012 2.66% -8.84% 3 12% 3.33% 0.01% 9/1/2012 -3.93% 45.55% 2.77% -5.40% 0.01% 10/1/2012 20.23% 3.12% -1.54% 0.28% 0.01% 11/1/2012 0.15% 13.82% 1.42% 2.25% 0.01% 12/1/2012 10.75% 78.46% 5.45% 8.03% 0.01% 1/1/2013 -7.14% 13.82% 2.95% 0.64% 0.00% 2/1/2013 8.79% 0.64% 7.98% 4.79% 0.00% 3/1/2013 42.49% 14.15% 454% 2.46% 0.00% 4/1/2013 81.07% 4.71% 1.23% -5.45% 0.00N 5/1/2013 9.82% -6.70% 2.76% 3.32% 0.00% 6/1/2013 25.07% 15.82% 8.90% -0.93% 0.00% 7/1/2013 25.86% 16.13% -758% -3.79% 0.00% 8/1/2013 14.42% 8.91% 1.08% 2.75% 0.00% 9/1/2013 -17.29% 4.29% 6 89% 0.32% 0.00% 10/1/2018 -20.42% 13.43% 2.2156 0.88% 0.00% 11/1/2013 18. 19% 0,65% -2.57% 0.48% 0.00% 12/1/2013 20.59% 11 15% -3.4196 -2.95% 0.00% 1/1/2014 34.95 8.87% 4.13% 1045 0.00% 2/1/2014 -14.85% -21.00% 7.40% 3.90% 0.00% 3/1/2014 -0.27% -8.52 3.12% 3.42% 0.00% 4/1/2014 -0.06% 29.74% 0.17% 0.05% 0.00% 5/1/2014 15.54 5.45% 3.83% 0.12% 0.00% 6/1/2014 -6.98% -4,06% -4.33% -6.13% 0.00% 7/1/2014 20.785 12.99% 3.64% -0.89% 0.00% 8/1/2014 -10.02% -5.54% 3.45% 204% 0.00% 9/1/2014 -0.40% - 12.95% 1 12% -1 14% 0.00% 10/1/2014 1.17% -11.76% 0.445 3.29% 11/1/2014 -9.045 1.44% -2364 0.00% 12/1/2014 -8.46% 29.33% 4245 -1.34% 0.00% 1/1/2015 0 13% 7.49% 2.37% 6.99% 0.00% 2/1/2015 -7.17% -12 26% -1 16% -0.62% 0.00% 3/1/2015 19.75% 33.55% -1.39% -0.91% 0.00% 4/1/2015 10.95% 12.145 0.95% -0.54% 0.00% 5/1/2015 6.96% 5.27% -1.97% -0.04% 0.00% 6/1/2015 -0.79% 21 80% 2.82% 5.04% 0.00% 7/1/2015 -6.42% 0.63% -6.22% -4.85% 0.00 8/1/2015 -0.26% - 10.23% 0.09% 4,61% 0.00% 9/1/2015 - 16 69% 496% 8.23% 13.9255 0.00% 0.00% 10/1/2015 11/1/2015 12/1/2015 1/1/2016 2/1/2016 3/1/2016 4/1/2016 S/1/2016 6/1/2016 7/1/2016 8/1/2016 9/1/2016 10/1/2016 11/1/2016 12/1/2016 1/1/2017 2/1/2017 3/1/2017 4/1/2017 5/1/2017 6/1/2017 7/1/2017 8/1/2017 9/1/2017 10/1/2017 11/1/2017 12/1/2017 1/1/2018 2/1/2018 3/1/2018 4/1/2018 5/1/2018 6/1/2018 7/1/2018 8/1/2018 9/1/2018 10/1/2018 11/1/2018 12/1/2018 1/1/2019 2/1/2019 3/1/2019 4/1/2019 5/1/2019 6/1/2019 7/1/2019 8/1/2019 9/1/2019 11 27% 4.23% -20.345 0.38% 19.7296 4.78% -7.28% -4.91% 10.60% -9.70% -3.76% -3.09% -4 21% 12 82 17.90% -0.77% 11 329 12 85% 8.58% 6.04% -10.55% 10.03% -4.15% -2815 -6.84% 0.81% 13.80 -3.18% -22.42% 10.455 3.1254 20.45% -13.07% 1 18% -12-2396 27.40% 3.90% -5.04% -7,75% 4. 19 12515 -14.71% -22.43% 20.68% 8 125 -6.62% 6.76% 30.74% 13.79% -7.26% -19.71% 1715 9.445 -1.93% 13.93% -10.81% -0.25% 6.79% 1.13% 26.719 -6.3056 5.815 13.66% 101% 400% 2.97% 7.14% -8.385 21 58% -3.8395 3.80 8.325 -4.515 2.34% 40.815 7.80% 1.36% 5.79% 12 595 11 33% -13.79% 8.96% 1.75% -19 34% -5.1996 -6.46% 26,84% 5.48% -0.43% 3.925 -7.36% 7.00% - 12.07% -9.05% -8.90% 7.39% 0215 2219 1.67% 0.745 3.59% 3.594 0.54% 84154 3.245 -4.705 -0.355 -181% 404% 4.23% -170 7915 2.59% -0.8736 3.87% 3.839 0.33% 0.26% -116 7 235 -0.06% 0.89 1.105 -60156 -0.70% -1.305 -5.439 2.1995 9.215 1.64% 3.27% 1325 4.945 - 11.59% 3 125 2.68% 2.985 1015 -7.125 6.935 -6.50% -1.43% 1.55% 2065 1.70% 43056 4779 -5.32% 8.06 0.545 -3.50 -1.413 -1525 1699 0.52% -2423 5.95% 2855 0.705 4 145 2208 7.96 7838 1505 1939 3.11% -1489 5.53% 30396 0.685 -0.57% -7.83% -0.295 7.07% 0.005 0.00% 0.01% 0.01% 0.02% 0.02% 0.01 0.01% 0.02% 0.02% 0.02% 0.02% 0.02% 0.01% 0.03% 0,04% 0.09% 0.03% 0.05% 0.06% 0.06% 0.07% 0.09% 0:09 0.09% 0.08% 0.09% 0.11% 0.11% 0.125 0.14% 0.14% 0.14% 0.16% 0.16% 0.15% 0.19% 0.18% 0.19% 0.2136 0.18% 0.19% 0.215 0.21% 0.18% 0 19% 0.16% 0.18% -20790 1199 2.96% 3.759 5.74% 6.56% -5.225 0.58% 28395 3.95% 400 0.35% 53556 1473 3.44 -0.97% 83986 10/1/2019 11/1/2019 12/1/2019 1/1/2020 2/1/2020 3/1/2020 4/1/2020 5/1/2020 6/1/2020 7/1/2020 8/1/2020 9/1/2020 10/1/2020 11/1/2020 12/1/2020 1/1/2021 2/1/2021 3/1/2021 4/1/2021 5/1/2021 6/1/2021 7/1/2021 8/1/2021 4.77% 26.79% 55.52% 2.68% -21.56% 49.21% 6.79% 29.32% 32.50% 74.15% -13.91% -9.55% 46.27% 24.33% 12.45% -14.87% -1.12% 6.21% -11.87% 8.71% 1.10% 7.06% 5.40% 9.48% 2.83% 6.65% 6.94% 1.75% 11.81% -0.03% 8.41% 7.44% 8.32% -5.58% -4.86% 3.14% 10.20% -1.54% 1.21% -3.19% -1.57% -2.08% 5.05% -2.01% 9.97% 7.23% 4.13% 5.83% 2.06% -9.67% -1.87% 14.42% -0.86% -4.80% 3.65% 5.25% -2.31% -7.91% 5.52% 9.53% 3.65% -2.86% 4.36% -0.99% 4.01% -2.06% 4.53% 0.54% -6.16% -1.13% 2.26% 8.28% -9.25% -14.31% 13.43% -0.66% -0.33% 5.32% 9.90% 3.40% -2.96% 2.08% -0.79% -3.14% -0.82% 9.40% 5.33% -0.93% -0.69% 5.07% -2.16% 2.09% 0.15% 0.12% 0.14% 0.13% 0.12% 0.12% 0.00% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts