Question: the Exhibit 1 is the answer , however I want to know how did we get the lease payment? the (13,500 ) what is it

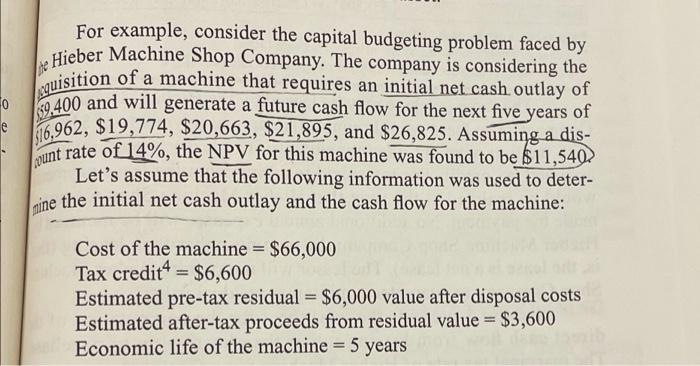

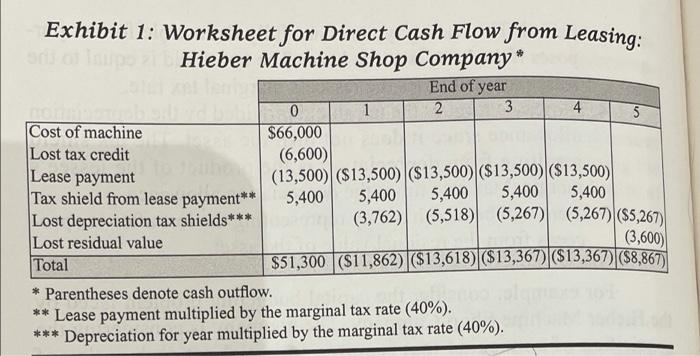

For example, consider the capital budgeting problem faced by Hieber Machine Shop Company. The company is considering the quisition of a machine that requires an initial net cash outlay of 19.400 and will generate a future cash flow for the next five years of $16,962,$19,774,$20,663,$21,895, and $26,825. Assuming a disount rate of 14%, the NPV for this machine was found to be $11,540. Let's assume that the following information was used to deterpine the initial net cash outlay and the cash flow for the machine: Cost of the machine =$66,000 Tax credit 4=$6,600 Estimated pre-tax residual =$6,000 value after disposal costs Estimated after-tax proceeds from residual value =$3,600 Economic life of the machine =5 years Exhibit 1: Worksheet for Direct Cash Flow from Leasing: Hieber Machine Shop Company* * Parentheses denote cash outflow. ** Lease payment multiplied by the marginal tax rate (40%). *** Depreciation for year multiplied by the marginal tax rate (40%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts