Question: The expected market return and risk for different assumptions about the state of the economy is shown below. State of Economy Fast growth Slow growth

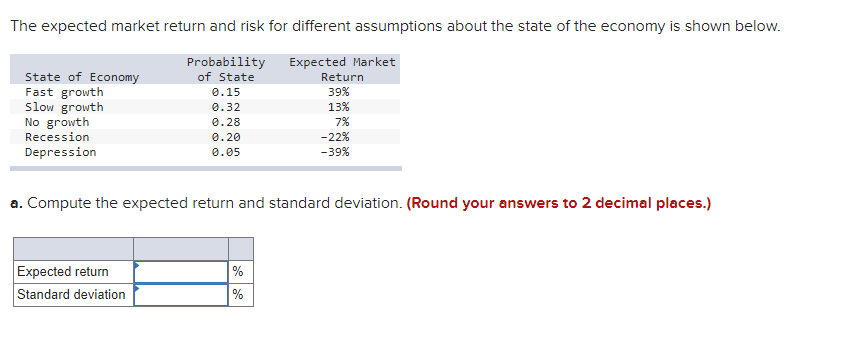

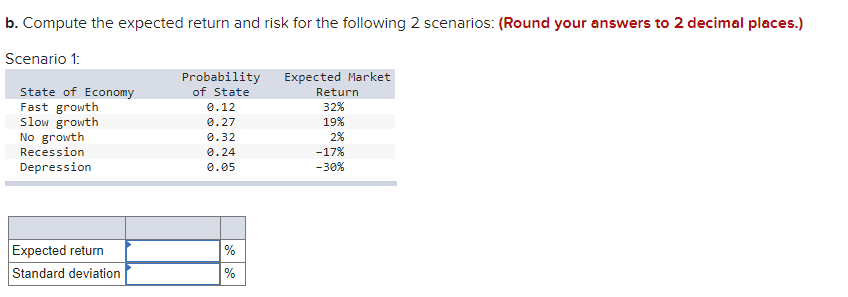

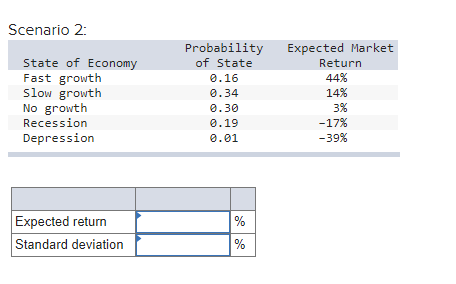

The expected market return and risk for different assumptions about the state of the economy is shown below. State of Economy Fast growth Slow growth No growth Recession Depression Probability of State 0.15 0.32 0.28 0.20 0.05 Expected Market Return 39% 13% 7% - 22% -39% a. Compute the expected return and standard deviation. (Round your answers to 2 decimal places.) Expected return Standard deviation % % b. Compute the expected return and risk for the following 2 scenarios: (Round your answers to 2 decimal places.) Scenario 1: State of Economy Fast growth Slow growth No growth Recession Depression Probability of State 0.12 0.27 0.32 0.24 0.05 Expected Market Return 32% 19% 2% -17% -30% % Expected return Standard deviation % Scenario 2: State of Economy Fast growth Slow growth No growth Recession Depression Probability of State 0.16 0.34 0.30 0.19 0.01 Expected Market Return 44% 14% 3% -17% -39% % Expected return Standard deviation %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts