Question: The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Required: a . If each stock is

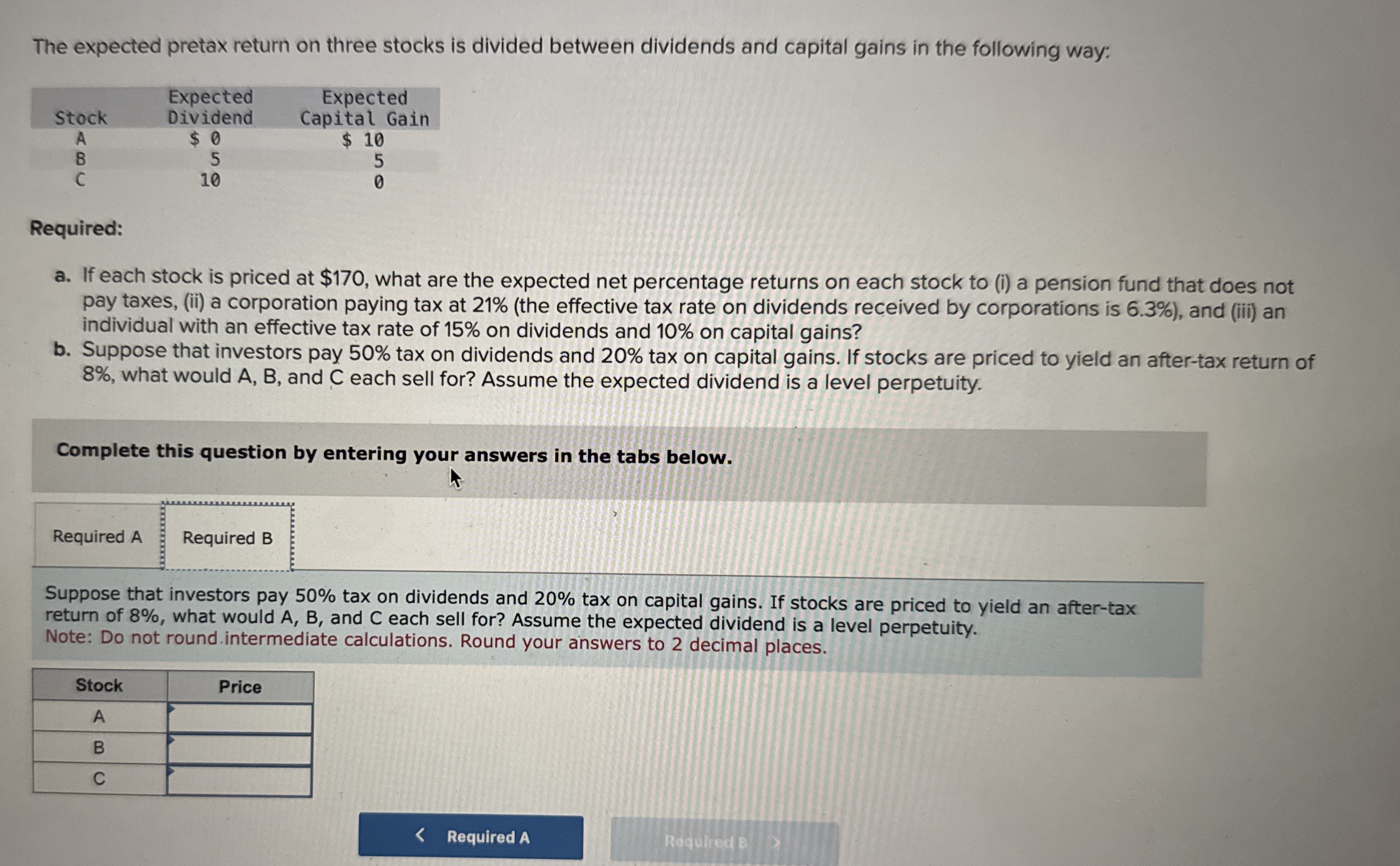

The expected pretax return on three stocks is divided between dividends and capital gains in the following way:

Required:

a If each stock is priced at $ what are the expected net percentage returns on each stock to i a pension fund that does not

pay taxes, ii a corporation paying tax at the effective tax rate on dividends received by corporations is and iii an

individual with an effective tax rate of on dividends and on capital gains?

b Suppose that investors pay tax on dividends and tax on capital gains. If stocks are priced to yield an aftertax return of

what would A B and C each sell for? Assume the expected dividend is a level perpetuity.

Complete this question by entering your answers in the tabs below.

Suppose that investors pay tax on dividends and tax on capital gains. If stocks are priced to yield an aftertax

return of what would A B and C each sell for? Assume the expected dividend is a level perpetuity.

Note: Do not round intermediate calculations. Round your answers to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock