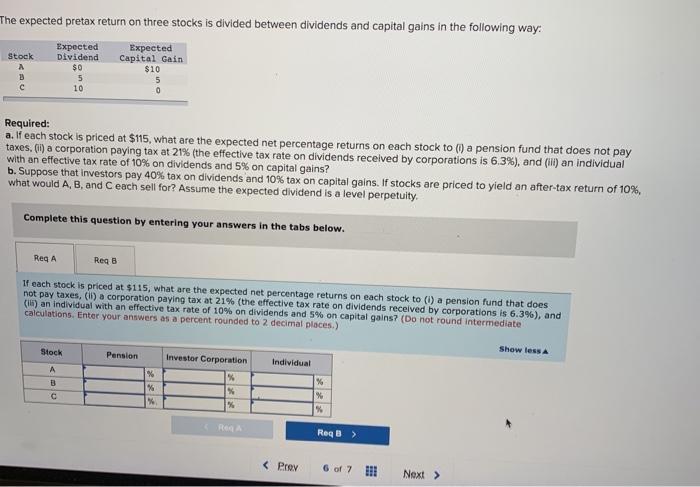

Question: The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Expected Dividend Expected Capital Gain Stock

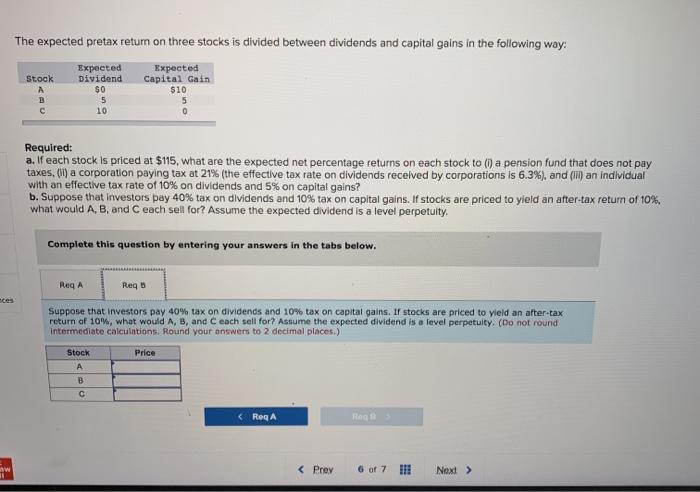

The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Expected Dividend Expected Capital Gain Stock $0 $10 5 5 10 Required: a. If each stock is priced at $115, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? b. Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. Complete this question by entering your answers in the tabs below. Req A Req B If each stock is priced at $115, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (ii) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Show less A Stock Pension Investor Corporation Individual A % B % Req A Next > C % % % < Prev % % % Req B > 6 of 7 The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Expected Dividend Expected Capital Gain Stock A $0 $10 B 5 5 C 10 Required: a. If each stock is priced at $115, what are the expected net percentage returns on each stock to (1) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (ii) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? b. Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. Complete this question by entering your answers in the tabs below. Req A Req B ces Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Stock Price A B < Req A Rog S 6 of 7 Next > ww 31 C < Prev The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Expected Dividend Expected Capital Gain Stock $0 $10 5 5 10 Required: a. If each stock is priced at $115, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? b. Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. Complete this question by entering your answers in the tabs below. Req A Req B If each stock is priced at $115, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (ii) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Show less A Stock Pension Investor Corporation Individual A % B % Req A Next > C % % % < Prev % % % Req B > 6 of 7 The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Expected Dividend Expected Capital Gain Stock A $0 $10 B 5 5 C 10 Required: a. If each stock is priced at $115, what are the expected net percentage returns on each stock to (1) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (ii) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? b. Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. Complete this question by entering your answers in the tabs below. Req A Req B ces Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Stock Price A B < Req A Rog S 6 of 7 Next > ww 31 C < Prev

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Expected return ER D x 1 TD CG x 1 TG P Where D expected ... View full answer

Get step-by-step solutions from verified subject matter experts