Question: The expected profit from 1 / 1 / 2 0 X 2 to 3 / 3 1 / 2 0 X 2 was based onRevsine'sexpectations

The expected profit from X to X was based onRevsine'sexpectations as ofX Assume the marginal tax rate is Required:In its X income statement, what should Revsine report as profit or loss from Determining loss discontinued operations LO

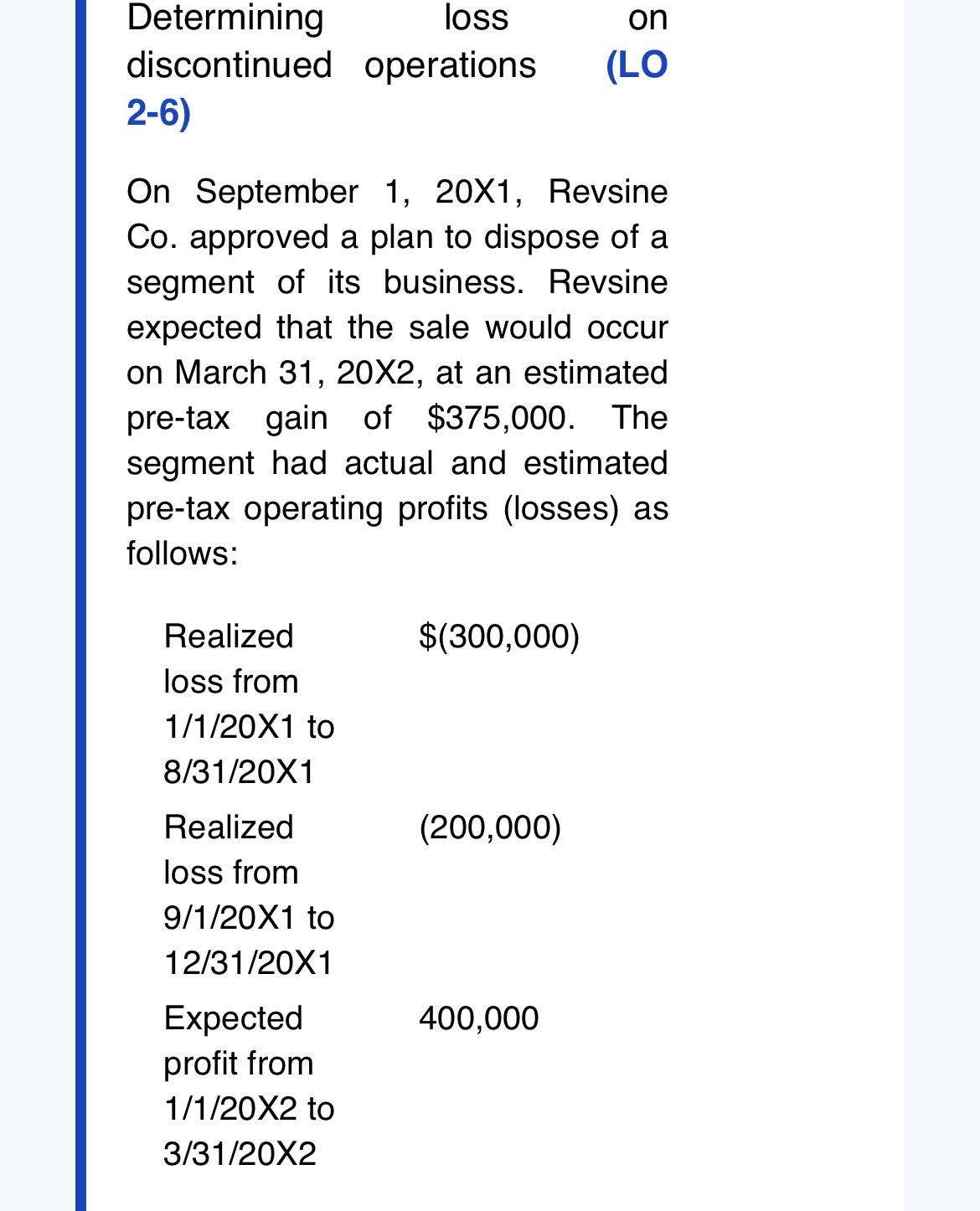

On September X Revsine Co approved a plan to dispose of a segment of its business. Revsine expected that the sale would occur on March X at an estimated pretax gain of $ The segment had actual and estimated pretax operating profits losses as follows:

tableRealized$discontinued operations net of tax effects

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock