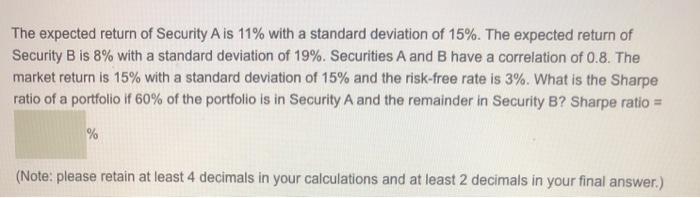

Question: The expected return of Security A is 11% with a standard deviation of 15%. The expected return of Security B is 8% with a standard

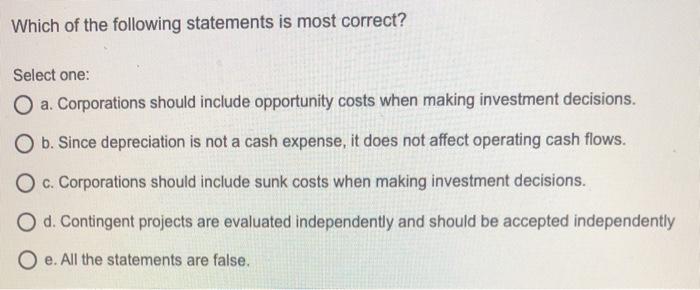

The expected return of Security A is 11% with a standard deviation of 15%. The expected return of Security B is 8% with a standard deviation of 19%. Securities A and B have a correlation of 0.8. The market return is 15% with a standard deviation of 15% and the risk-free rate is 3%. What is the Sharpe ratio of a portfolio if 60% of the portfolio is in Security A and the remainder in Security B? Sharpe ratio = % (Note: please retain at least 4 decimals in your calculations and at least 2 decimals in your final answer.) Which of the following statements is most correct? Select one: O a. Corporations should include opportunity costs when making investment decisions. O b. Since depreciation is not a cash expense, it does not affect operating cash flows. O c. Corporations should include sunk costs when making investment decisions. O d. Contingent projects are evaluated independently and should be accepted independently Oe. All the statements are false

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts