Question: The expected return on foreign stocks, in local currency, is: r = D/P + Br where r is the expected return, D/P is the

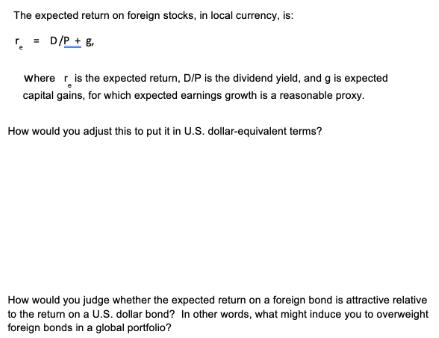

The expected return on foreign stocks, in local currency, is: r = D/P + Br where r is the expected return, D/P is the dividend yield, and g is expected capital gains, for which expected earnings growth is a reasonable proxy. How would you adjust this to put it in U.S. dollar-equivalent terms? How would you judge whether the expected return on a foreign bond is attractive relative to the return on a U.S. dollar bond? In other words, what might induce you to overweight foreign bonds in a global portfolio?

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

The predicted return on foreign equities must be converted from the local currency into US dollars b... View full answer

Get step-by-step solutions from verified subject matter experts