Question: The expected return on Kiwi Computers stock is 16.6 percent. If the risk-free rate is 4 percent and the expected return on the market is

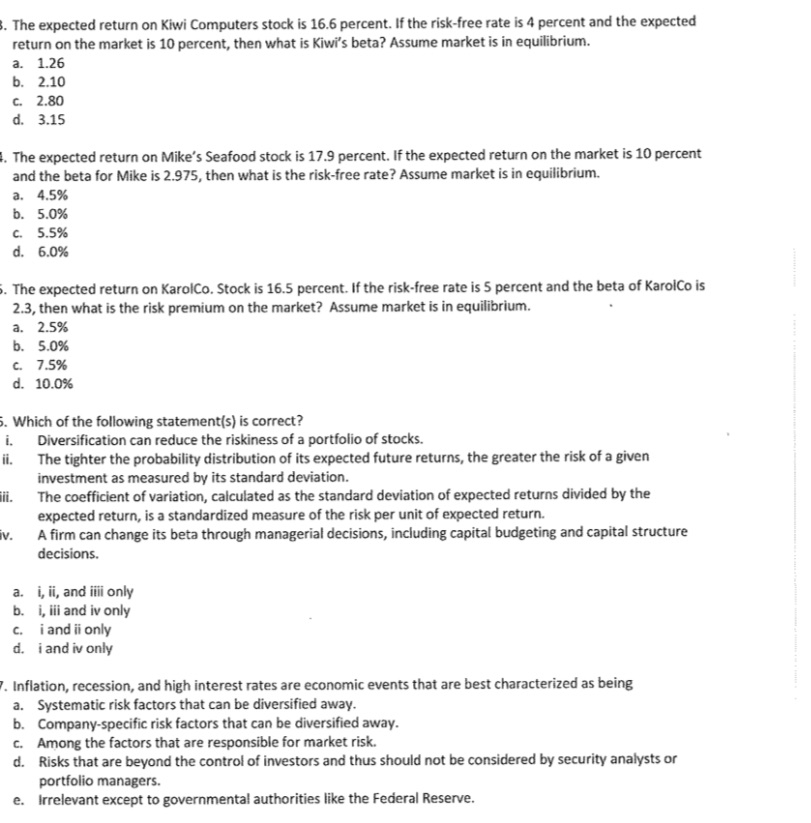

The expected return on Kiwi Computers stock is 16.6 percent. If the risk-free rate is 4 percent and the expected return on the market is 10 percent, then what is Kiwi's beta? Assume market is in equilibrium. a. 1.26 b. 2.10 2.80 d. 3.15 The expected return on Mike's Seafood stock is 17.9 percent. If the expected return on the market is 10 percent and the beta for Mike is 2.975, then what is the risk-free rate? Assume market is in equilibrium. a. 4.5% b. 5.0% 5.5% d. 6.0% The expected return on KarolCo. Stock is 16.5 percent. If the risk-free rate is 5 percent and the beta of KarolCo is 2.3, then what is the risk premium on the market? Assume market is in equilibrium. a. 2.5% b. 5.0% C. 7.5% d. 10.0% Which of the following statement(s) is correct? Diversification can reduce the riskiness of a portfolio of stocks. The tighter the probability distribution of its expected future returns, the greater the risk of a given investment as measured by its standard deviation. The coefficient of variation, calculated as the standard deviation of expected returns divided by the expected return, is a standardized measure of the risk per unit of expected return. A firm can change its beta through managerial decisions, including capital budgeting and capital structure decisions. a. i, ii, and illi only b. i, ili and iv only c. i and ii only d. i and iv only . Inflation, recession, and high interest rates are economic events that are best characterized as being a. Systematic risk factors that can be diversified away. Company-specific risk factors that can be diversified away. . Among the factors that are responsible for market risk. Risks that are beyond the control of investors and thus should not be considered by security analysts or portfolio managers. e. Irrelevant except to governmental authorities like the Federal Reserve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts