Question: The expected return on MSFT next year is 12% with a standard deviation of 20%. The expected returm on AAPL next vear is 24% with

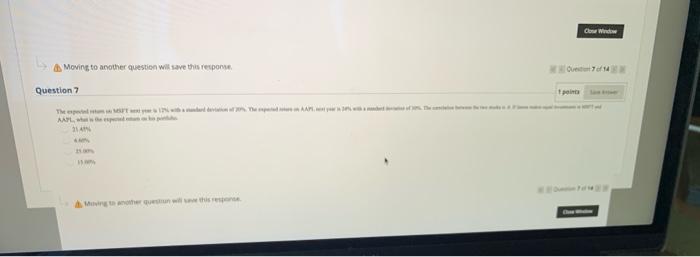

The expected return on MSFT next year is 12% with a standard deviation of 20%. The expected returm on AAPL next vear is 24% with a standard deviation of 30%. The corelation between the two stocks is .6. if james makes equal investments in MSFT and AAPL, what is the expected retum on his portfolio.

a. 21.45%

b. 4.60%

c. 25.00%

d. 15.00%

Come Window Moving to another question will save this response Ovestit Question 7 The Time AAL 24

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock