Question: the Expected return on security m is 3.80% and the standard deviation on m is 3.89% The following is a probability distribution for returns on

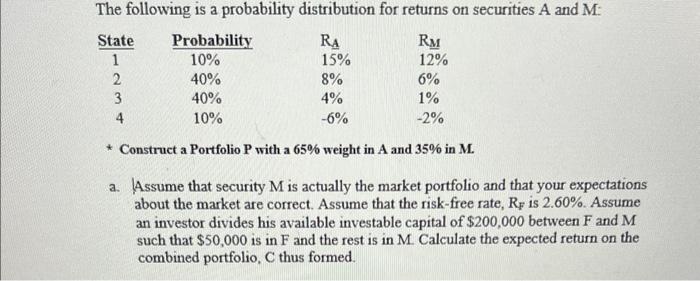

The following is a probability distribution for returns on securities A and M: * Construct a Portfolio P with a 65% weight in A and 35% in M. a. Assume that security M is actually the market portfolio and that your expectations about the market are correct. Assume that the risk-free rate, RF is 2.60%. Assume an investor divides his available investable capital of $200,000 between F and M such that $50,000 is in F and the rest is in M. Calculate the expected return on the combined portfolio, C thus formed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts